Pakistan mein credit card fraud aksar logon ke liye ek “door ki cheez” lagti hai — jab tak khud ke sath na ho. Zyada tar victims yeh baat baad mein realize karte hain ke unhon ne koi bari ghalti nahi ki thi, phir bhi paisa quietly nikal chuka hota hai. Fraud aksar dramatic nahi hota; yeh dheere dheere, choti transactions ke zariye, bina alarm ke hota hai.

Yeh credit card fraud protection Pakistan guide un logon ke liye hai jo credit card ko safe rehne ke bharose par use kar rahe hain, lekin yeh nahi jaante ke asal risk kahan se aata hai aur kaise unnoticed reh jata hai.

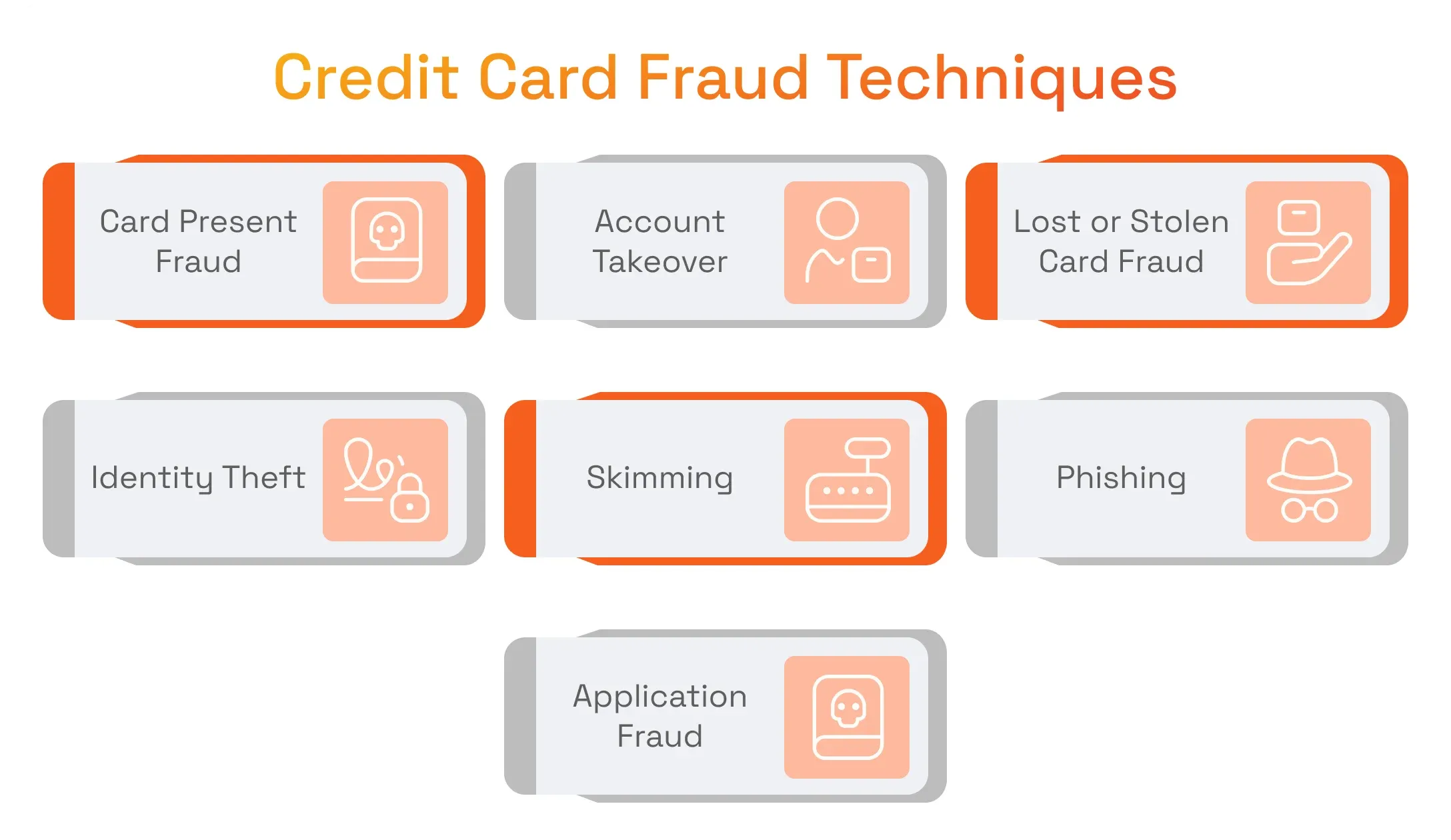

Pakistan Mein Credit Card Fraud Aksar Kaise Shuru Hota Hai?

Fraud hamesha hacking se shuru nahi hota

Log samajhte hain ke fraud ka matlab hacking ya sophisticated cyber attack hota hai. Reality mein Pakistan mein zyada tar fraud simple human behaviour se start hota hai — jaise ek link par click karna, ek call par trust kar lena, ya ek app bina soche samjhe install kar lena.

| Starting Point | Risk Level |

| Phishing SMS / email | High |

| Fake customer support call | Very High |

| Unknown shopping website | High |

| Public Wi-Fi payments | Medium |

| Unsafe apps | High |

Fraud ka pehla step aksar information exposure hota hai, paisa baad mein nikalta hai.

Phishing – Sab Se Common Aur Sab Se Dangerous Fraud

“Verify your account” wali trick

Phishing messages Pakistan mein bohot common ho chuke hain. SMS ya email aata hai jisme likha hota hai ke “account block ho raha hai” ya “transaction pending hai”. Panic mein user link par click karta hai aur apni details khud hi de deta hai.

Yahan log kaise phans jaate hain

- Message bilkul professional lagta hai

- Bank ka naam use hota hai

- Urgency create ki jati hai

Yeh fraud technical se zyada psychological hota hai.

Fake Calls Aur Impersonation Fraud

“Main bank se bol raha hoon” ka jhoot

Bohot se log phone par khud ko bank representative kehne walon par trust kar lete hain. Caller confidence ke sath baat karta hai aur user se OTP ya card details maang leta hai.

| Call Type | Reality |

| “Security verification” | Fraud |

| “Card upgrade offer” | Scam |

| “Suspicious activity alert” | Often fake |

Bank kabhi bhi OTP ya full card number phone par nahi maangta — yeh rule ignore karna sab se mehnga sabit hota hai.

Small Transactions – Big Loss Ka Silent Start

Fraud hamesha bara amount se start kyun nahi hota

Aksar fraudsters pehle 100, 200 ya 500 rupay ki transaction karte hain. Is ka reason simple hota hai: user alert ko ignore kar de.

| Transaction Size | User Reaction |

| Very small | Ignore |

| Medium | Confused |

| Large | Panic |

Jab tak user notice karta hai, multiple transactions already ho chuki hoti hain.

Online Shopping Aur Card Saving Ka Risk

“Save card for future” ka hidden nuksaan

Online shopping platforms par card save karna convenient lagta hai, lekin agar website ka data leak ho jaye to aapka card indirect risk mein aa jata hai.

| Card Storage | Risk |

| Browser autofill | High |

| Unknown websites | Very High |

| Trusted platforms | Medium |

Card jitni zyada jagah save hota hai, exposure utna hi barhta hai.

Public Wi-Fi Aur Free Internet Ka Fraud Connection

Free cheez aksar mehngi hoti hai

Airports, cafes aur public places par free Wi-Fi par payment karna bohot risky hota hai. Aise networks par data intercept ho sakta hai.

| Network Type | Safety Level |

| Home Wi-Fi | High |

| Mobile data | High |

| Public Wi-Fi | Low |

Credit card fraud mein location aur network bhi role play karte hain.

Fraud Hone Ke Baad Log Sab Se Bari Ghalti Kya Karte Hain?

Delay karna

Log aksar sochte hain ke “shayad bank khud dekh lega” ya “pehle confirm kar leta hoon”. Yeh delay nuksaan ko barha deta hai.

| Action Time | Result |

| Immediate report | Loss limited |

| Few hours delay | Moderate loss |

| Days delay | Heavy loss |

Fraud mein speed sab se bara defence hoti hai.

Credit Card Statements – Protection Ka Sab Se Sasta Tool

Statement sirf bill nahi hota

Statement mein har transaction ka record hota hai. Jo log statement detail mein dekhte hain, un ka fraud loss usually kam hota hai.

| Statement Habit | Fraud Risk |

| Ignore details | High |

| Monthly review | Medium |

| Weekly check | Low |

Statement check karna boring ho sakta hai, lekin effective hota hai.

Devices Aur Apps Ka Role Credit Card Fraud Mein

Card safe, phone unsafe

Agar phone mein malware ya pirated apps installed hon, to card details leak ho sakti hain.

Common risky habits

- Pirated apps install karna

- Unknown APK files

- Outdated operating system

Fraud sirf card ki wajah se nahi, device ki wajah se bhi hota hai.

Credit Card Fraud Se Bachne Ke Practical Rules

Simple habits jo kaam karti hain

- OTP kabhi share na karein

- Card details kahin forward na karein

- Alerts hamesha ON rakhein

- Unknown links ignore karein

- Online limits low rakhein

Security ek habit hai, setting nahi.

Credit Card Fraud Aur Emotional Impact

Paisa se zyada trust lose hota hai

Fraud ke baad log sirf paisa nahi, balkay digital systems par trust bhi kho dete hain. Is liye prevention sirf financial nahi, mental peace ka issue bhi hai.

Fraud Se Bachne Ke Liye Daily Monitoring Ka Realistic System

Har cheez automate karna kyun kaam nahi karta

Bohot se log yeh soch lete hain ke alerts ON kar dene se kaam khatam ho gaya. Alerts zaroori hain, lekin blind reliance risky hota hai. Kabhi network issue hota hai, kabhi alert late aata hai, aur kabhi notification miss ho jati hai. Is liye ek manual backup habit bhi honi chahiye.

Simple daily habit jo kaam karti hai

Din ke end par sirf 30 seconds ke liye:

- last 2–3 transactions dekh lena

- amount aur merchant name verify kar lena

Yeh choti si aadat bohot se logon ko bari loss se bacha chuki hai.

Email Aur SMS Overload – Fraud Ka Silent Helper

Jab asli alerts aur fake messages mix ho jate hain

Pakistan mein log roz dozens of SMS aur emails receive karte hain. Fraudsters isi overload ka faida uthate hain. Jab inbox bhara hota hai, to fake alert asli jaisa lagta hai aur user bina soche react kar deta hai.

| Message Type | Safe Response |

| Urgent tone + link | Ignore |

| OTP request | Never share |

| Generic greeting | Suspicious |

| Bank name + threat | Verify separately |

Rule simple hai: bank ke message par click nahi, bank ke app ya official number se verify.

Social Media Par Credit Card Fraud Ka Naya Rasta

“Deals”, “Giveaways” aur fake ads

Facebook aur Instagram par bohot se fake ads chal rahe hotay hain jo unbelievable discounts ya giveaways ka wada karte hain. In ads par click kar ke log fake checkout pages par land kar jate hain.

Common red flags

- Prices unrealistically low

- Comment section limited ya disabled

- Payment ke liye external link

Online shopping ka golden rule yahan bhi apply hota hai: deal jitni zyada sweet, risk utna hi high.

Travel Aur Credit Card Fraud – Extra Care Kyun Zaroori Hai?

Location change se security flags ka issue

Jab aap travel karte hain, to card transactions different locations se hoti hain. Fraudsters isi confusion ka faida uthate hain, aur kabhi kabhi genuine transactions bhi suspicious lagne lagti hain.

| Travel Phase | Recommended Action |

| Before travel | Limits set + alerts check |

| During travel | Daily review |

| After return | Statement audit |

Travel ke baad ek proper statement check karna fraud detection ke liye bohot effective hota hai.

Credit Card Freeze Feature Ko Normalize Karna

Freeze karna panic nahi, smart move hai

Kuch log card freeze ko extreme step samajhte hain. Reality mein freeze ek temporary safety switch hota hai. Agar kabhi doubt ho — chahe chota hi kyun na ho — freeze kar dena nuksaan ko zero tak la sakta hai.

| Action | Outcome |

| Freeze immediately | Damage stopped |

| Wait for confirmation | Risk continues |

| Ignore suspicion | Loss increases |

Freeze ko panic nahi, preventive maintenance samajhna chahiye.

Fraud Awareness Aur Family Communication

Ghar ke ek member ki ghalti sab ko mehngi par sakti hai

Aksar ek hi credit card poore ghar mein use hota hai. Agar family ke kisi member ko fraud awareness na ho, to risk sab ke liye barh jata hai.

Practical approach

- Family ke sath basic rules share karein

- OTP aur calls ke hawale se clarity dein

- Kids ko bhi online payment awareness sikhayein

Fraud protection tab effective hoti hai jab ghar ka system aligned ho.

“Mujhe Kuch Nahi Hoga” Mindset Ka Nuksaan

Overconfidence sab se bara threat

Zyada tar victims yeh keh kar shuru karte hain: “Mere sath aisa nahi ho sakta.” Yeh mindset hi fraud ka sab se bara entry point hota hai. Awareness ka matlab darna nahi, balkay alert rehna hota hai.

Fraud Ke Baad Jo Log Andar Hi Andar Ghalat Decisions Lete Hain

Ghalti sirf fraud ki nahi hoti, reaction ki bhi hoti hai

Fraud hone ke baad bohot se log extreme side par chalay jate hain. Ya to credit card bilkul use karna chhor dete hain, ya phir itne careless ho jate hain ke “jo hona tha ho gaya”. Dono approaches unhealthy hain. Fraud ke baad balanced recovery mindset zaroori hota hai.

Balanced approach ka matlab hota hai:

- card ka use band nahi, control mein lana

- har transaction par panic nahi, awareness rakhna

- ek ghalti ko lifelong fear mein convert na karna

Fraud ka sab se bara nuksaan paisa nahi, decision confidence ka loss hota hai.

Credit Card Fraud Aur Credit Score Ka Chhupa Hua Link

Fraud report na karna future mein mehnga kyun parta hai

Kuch log choti fraud amount dekh kar sochte hain ke “chhor do, time waste hai”. Lekin jab fraud officially report nahi hota, to card statement par woh amount valid charge jaisa treat hota rehta hai. Agar payment late ho jaye, to credit history quietly damage ho sakti hai.

| Behaviour | Long-Term Effect |

| Fraud ignore karna | Credit score impact |

| Late payment | Penalties + record |

| Timely dispute | Protection |

Is liye fraud ka case sirf paisay ka nahi, financial profile ka bhi hota hai.

Credit Card Close Karna Kab Sahi Decision Hota Hai?

Har fraud ke baad card band karna zaroori nahi

Kuch situations mein card close karna sahi hota hai, lekin har case mein nahi.

| Situation | Card Close Karna? |

| Repeated fraud incidents | Haan |

| Single minor fraud | Zaroori nahi |

| Bank response weak | Haan |

| User habits improve ho sakti hain | Nahi |

Behtar approach yeh hoti hai ke pehle controls strong kiye jaen, phir decision liya jaye.

Fraud Prevention Mein Routine Ka Role

Jab safety habit ban jaye

Jo users fraud se bach jate hain, woh koi special log nahi hotay. Un ke paas sirf ek boring routine hota hai:

- week mein ek dafa statement check

- random links ignore

- unknown calls disconnect

- limits aur alerts regularly review

Yeh routine exciting nahi hota, lekin effective hota hai.

“Digital Literacy” Ka Matlab Sirf Technology Nahi

Soch ka update bhi zaroori hota hai

Digital literacy ka matlab sirf apps chalana nahi hota. Is ka matlab hota hai:

- urgency ko question karna

- free cheez par doubt karna

- authority claims ko verify karna

Fraudsters technology se zyada human emotions exploit karte hain — darr, lalach aur confusion.

Credit Card Fraud Se Bachne Ka Long-Term Formula

Shortcuts nahi, systems kaam karte hain

Fraud protection ka koi ek magic trick nahi hota. Yeh multiple small systems ka combination hota hai:

- technical (alerts, limits, freeze)

- behavioural (habits, discipline)

- emotional (panic control, patience)

Jab yeh teenon align ho jate hain, tab credit card risk nahi rehta, balkay controlled tool ban jata hai.

FAQs – Credit Card Fraud Protection in Pakistan

- Pakistan mein credit card fraud common hai?

Haan, lekin zyada tar cases avoidable hotay hain.

- Fraud hone par bank zimmedar hota hai?

Depends karta hai reporting time aur case par.

- OTP share karna safe hai?

Kabhi bhi nahi.

- Debit card fraud aur credit card fraud mein farq?

Credit card recovery easier hoti hai.

- Small transactions ignore karni chahiye?

Nahi, yeh red flag hoti hain.

- Public Wi-Fi par shopping safe hai?

Avoid karni chahiye.

- Fraud report karne ka best time?

Foran.

- Statement kitni baar check karein?

Kam az kam mahine mein aik baar.

- Phone hacked ho to kya karein?

Card freeze aur device clean karein.

- Virtual cards fraud se bachate hain?

Haan, kaafi had tak.

- Family ke sath card share karna safe hai?

Risk barhta hai.

- Fraud amount wapas mil sakta hai?

Kai cases mein mil jata hai.

- Unknown apps ka kya nuksaan hai?

Data leak ka risk.

- Credit card bina online use ke safe rehta hai?

Risk kam hota hai, zero nahi.

- Fraud se bachne ka golden rule?

Alert raho, delay na karo.

See also:

Best Credit Card for Online Shopping Pakistan and Which One Is Safe for Online Shopping?

Best Savings Account Pakistan in 2026 – Profit, Risks and Reality

Medical Insurance Low Budget – Pakistan Family Survival Guide

Term Life Insurance Meaning in Pakistan – Kya Yeh Savings Plans Se Behtar Hai?

Health Insurance Pakistan Main Leni Chahiye Ya Nahi? Complete Reality Check

How to Save Money in Pakistan (Without Unrealistic Advice)

Conclusion of Credit Card Fraud Protection Pakistan

Credit card fraud Pakistan mein koi rare cheez nahi rahi, lekin yeh bhi sach hai ke majority losses simple habits se avoid ho sakte hain. Technology aaj secure hai, lekin human behaviour abhi bhi weakest link hai.

Jo log:

- alerts ko seriously lete hain

- statements ko regularly check karte hain

- panic ke bajaye process follow karte hain

woh sirf paisa nahi, peace of mind bhi protect kar lete hain.

Credit card fraud Pakistan mein zyada tar logon ki aankhon ke samne hota hai, lekin samajh baad mein aata hai. Fraud ka sab se bara sabab technology nahi, over-trust aur lack of awareness hoti hai. Jo log rules ko boring samajh kar bhi follow karte hain, wahi apna paisa aur sukoon dono protect kar pate hain.

Yeh toh bahut badi samasya hai, abhi tak bahut se log isse bhugat rahe hain. Mujhe ummeed hai ki ispe raastaa milenge.

Jee bilkol. Awareness phelaana sab ka kaam hai – aapka aur hamara – taakay log credit card fraud se bache rahein.

More awareness articles to come!