Pakistan mein credit card ka naam sunte hi do tarah ke reactions aate hain. Kuch log samajhte hain ke credit card sirf ameer logon ke liye hota hai, jab ke kuch log isay risky aur dangerous cheez maan kar avoid karte hain.

Reality in dono extremes ke beech hoti hai. Credit card asal mein ek financial tool hai — sahi use ho to faida deta hai, aur ghalat use ho to nuksaan.

Zyada tar log credit card is liye reject ho jate hain kyun ke unhein apply karne ka proper tareeqa, eligibility aur bank ki expectations ka andaza nahi hota.

Is Pakistan mein credit card apply karne ka tareeqa guide ka maqsad yeh hai ke credit card ko simple alfaaz mein samjhaya jaye aur har step clear kiya jaye.

Credit Card Apply Karne Se Pehle Yeh Samajhna Zaroori Hai

Credit Card Aur Debit Card Mein Farq

Debit card aap ke apne paisay se linked hota hai, jab ke credit card bank ke paisay par based hota hai. Matlab credit card par jo kharcha hota hai, woh aap baad mein bank ko wapas karte hain. Isi wajah se bank credit card dene se pehle aap ki repayment capacity check karta hai.

Credit Card Sab Ko Kyun Nahi Milta

Bank ke liye credit card ek risk hota hai. Is liye bank sirf us shakhs ko credit card deta hai jo income, job stability aur record ke hisaab se reliable lagta ho.

Pakistan Mein Credit Card Eligibility – Ground Reality

Salary Based Applicants

Agar aap job kar rahe hain to bank sab se pehle aap ki monthly income aur job continuity dekhta hai. Zyada tar banks kam az kam 6 mahine ki job history aur minimum salary requirement rakhte hain.

Business / Self-Employed Applicants

Business walon ke liye credit card thora zyada challenging hota hai kyun ke income fluctuate karti hai. Is liye bank tax returns aur bank statements zyada detail mein check karta hai.

Credit Card Eligibility Table

| Criteria | Salary Person | Business Person |

| Minimum income | Fixed salary | Stable average income |

| Job / business duration | 6–12 months | 1–2 years |

| Bank statement | Required | Strongly required |

| Tax record | Preferred | Very important |

Credit Card Apply Karne Ke Liye Required Documents

Salary Walon Ke Documents

Salary slip, CNIC copy, bank statement aur employment letter commonly required hotay hain. Yeh documents bank ko yeh batate hain ke income real aur consistent hai.

Business Walon Ke Documents

Business registration proof, tax returns, bank statements aur CNIC required hota hai. Yahan consistency sab se zyada important hoti hai.

Credit Card Apply Karne Ka Step-by-Step Tareeqa

Step 1: Apni Eligibility Check Karein

Apply karne se pehle apni income aur job status realistically assess karein. Agar income bank criteria se kam hai, to apply karna time waste hota hai.

Step 2: Sahi Credit Card Choose Karein

Har credit card same nahi hota. Kuch cards shopping ke liye best hotay hain, kuch travel ke liye, aur kuch basic usage ke liye. Beginner ke liye basic credit card se start karna behtar hota hai.

Step 3: Application Form Fill Karein

Application form mein di gayi information bilkul accurate honi chahiye. Income ya job details ghalat dena rejection ka sab se common reason hota hai.

Step 4: Document Submission

Documents complete aur clear hon. Incomplete documents se application delay ya reject ho jati hai.

Step 5: Bank Verification Call

Bank aksar verification call karta hai jahan job, income aur address confirm kiya jata hai. Is call ko casually lena ghalat hota hai.

Step 6: Approval Aur Credit Limit

Approval ke baad bank aap ko ek credit limit assign karta hai jo aap ki income aur profile par depend karti hai.

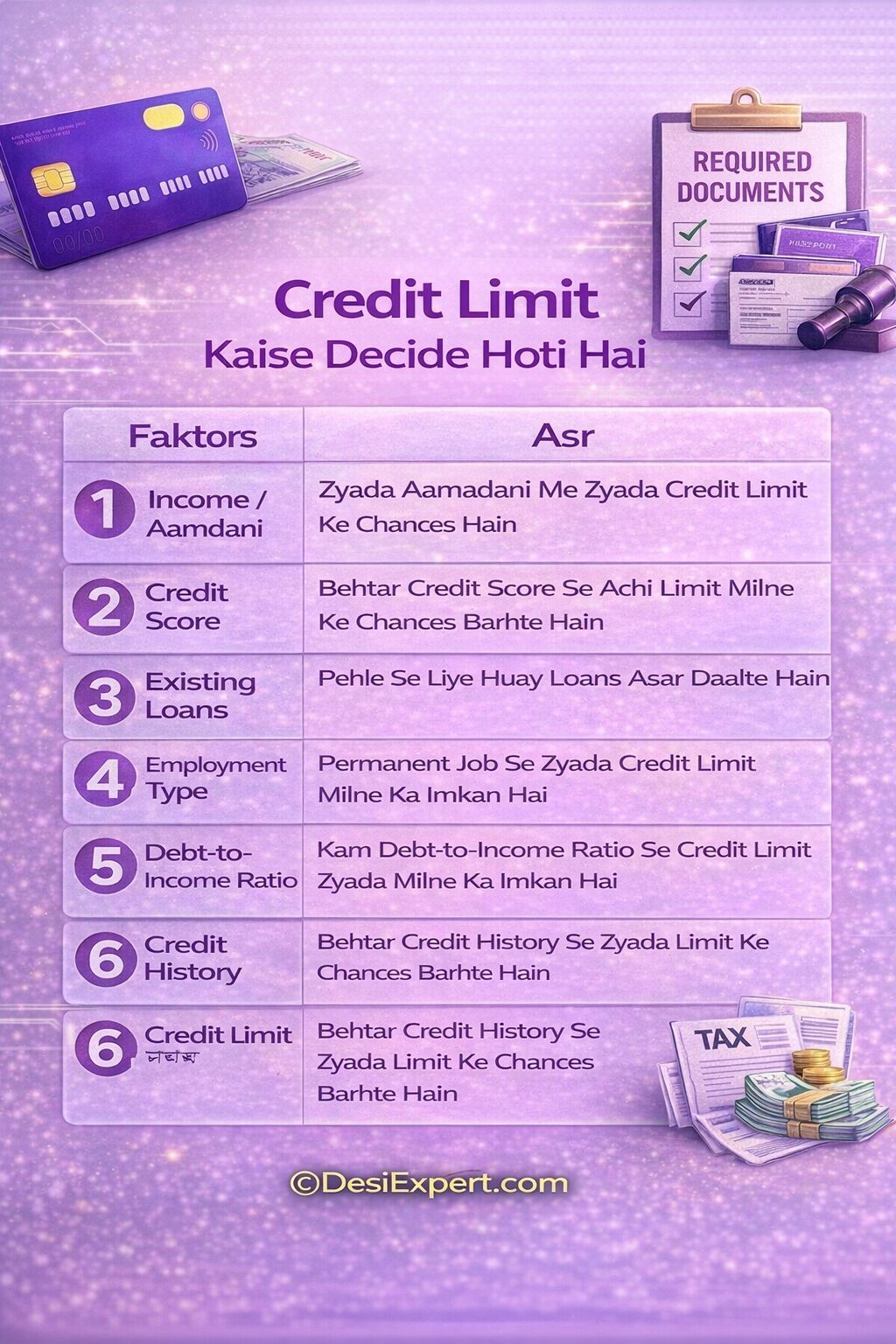

Credit Limit Kaise Decide Hoti Hai

Credit limit aap ki salary ka multiple hoti hai. Beginner ko aksar kam limit milti hai, jo time ke sath barh sakti hai agar usage responsible ho.

Credit Card Use Karne Ke Golden Rules

Full Payment On Time

Credit card ka sab se safe use yeh hai ke har mahine full bill time par pay kiya jaye. Sirf minimum payment karna long-term mein mehnga par sakta hai.

Limit Ka Overuse Na Karein

Credit limit ka 100% use karna credit profile ke liye negative hota hai. 30–40% usage safe mana jata hai.

Credit Card Ke Common Charges Table

| Charge Type | Short Explanation |

| Annual fee | Card rakhne ka yearly charge |

| Late payment | Due date miss hone par |

| Cash advance | ATM se cash nikalne par |

| Markup | Outstanding amount par |

Credit Card Rejection Ke Common Reasons

Income Criteria Meet Na Karna

Aksar log apply kar dete hain jab income bank requirement se kam hoti hai.

Weak Bank History

Irregular transactions ya negative record bank ke liye red flag hota hai.

Multiple Applications

Ek sath bohat saaray banks mein apply karna profile ko weak bana deta hai.

Beginners Ke Liye Safe Credit Card Strategy

Credit card ko emergency ya convenience tool ke taur par use karein, lifestyle upgrade ke liye nahi. Jo log credit card ko “extra income” samajhte hain, woh aksar problem mein phans jate hain.

Credit Card Ka Credit Score Par Asar

Time par payments aur controlled usage credit score ko strong banata hai. Late payments aur overuse credit score ko damage karta hai, jis ka asar future loans par padta hai.

Beginners Ke Liye Credit Card Choose Karna Kyun Mushkil Hota Hai

Pakistan mein jab koi pehli dafa credit card lene ka sochta hai, to sab se bari confusion yeh hoti hai ke kaunsa card shuruat ke liye safe aur manageable hai. Advertisements rewards, discounts aur cashback par focus karti hain, jab ke beginner ke liye asal sawal yeh hota hai:

“Is card ko main bina phansay use kar paunga ya nahi?”

Beginners ke liye credit card ka matlab luxury ya shopping tool nahi hota, balkay credit history build karna aur emergency flexibility hota hai. Isi liye pehla card hamesha simple, low-risk aur easy-to-manage hona chahiye.

Beginner Credit Card Mein Kin Cheezon Par Focus Karna Chahiye

Simple Structure, Zyada Features Nahi

Beginner ke liye zyada features aksar confusion create kar dete hain. Airport lounge, dining deals aur premium rewards baad mein useful hotay hain. Shuruat mein clear billing, easy statement aur reasonable charges zyada important hotay hain.

Low Credit Limit Ka Faida

Low credit limit beginner ke liye protection hoti hai. Is se over-spending ka risk kam hota hai aur repayment discipline build hoti hai. Zyada limit shuru mein temptation create karti hai jo aksar problem ban jati hai.

Easy Eligibility Criteria

Beginners ke liye woh cards zyada suitable hotay hain jahan salary aur documentation requirements realistic hon. Bohot strict criteria wale cards aksar rejection ka sabab bante hain.

Best Beginner Credit Cards – Pakistan (Comparison Table)

(Yeh table beginner decision ko easy banane ke liye design ki gayi hai, kisi ek bank ko promote karne ke liye nahi)

| Card Type | Best For | Annual Fee Level | Credit Limit Style | Beginner Friendly Level |

| Basic Classic Credit Card | First-time users | Low | Entry-level | ⭐⭐⭐⭐⭐ |

| Salary-Based Credit Card | Job holders | Low–Medium | Salary multiple | ⭐⭐⭐⭐ |

| Secured Credit Card | Low income / new profiles | Low | Fixed deposit linked | ⭐⭐⭐⭐⭐ |

| Student / Starter Card | Entry-level earners | Very Low | Very limited | ⭐⭐⭐⭐ |

| Co-branded Basic Card | Brand shoppers | Medium | Controlled | ⭐⭐⭐ |

| Gold Category (Entry) | Slight experience | Medium | Moderate | ⭐⭐⭐ |

Table Insight (Important)

- Secured credit cards beginners ke liye sab se safe option hotay hain kyun ke bank risk kam leta hai aur approval chances zyada hotay hain.

- Classic ya basic cards un logon ke liye best hotay hain jo pehli dafa credit system mein enter kar rahe hotay hain.

- Gold category beginners ke liye tabhi theek hoti hai jab income aur discipline dono strong hon.

Secured Credit Card – Beginners Ka Hidden Best Option

Bohot se beginners secured credit card ko ignore kar dete hain, jab ke yeh credit history build karne ka sab se safe tareeqa hota hai. Is card mein aap ek fixed amount deposit karte hain, aur usi ke against credit limit milti hai.

Is ka faida yeh hota hai ke:

- Approval chances bohot high hotay hain

- Over-spending ka risk kam hota hai

- Time ke sath unsecured card ke liye eligibility improve hoti hai

Beginners jo pehle hi rejection face kar chuke hon, un ke liye secured card ek smart restart hota hai.

Beginner Credit Card Use Strategy (Real-Life Approach)

Pehle 6 Mahine Ka Rule

Beginners ke liye pehle 6 mahine sirf discipline build karne ke hotay hain. Is period mein:

- Sirf necessary expenses credit card par karein

- Full payment har month karein

- Cash advance bilkul avoid karein

Yeh 6 mahine future credit profile decide kar dete hain.

Credit Card Ko Income Mat Samjhein

Bohot se beginners credit card ko “extra paisa” samajh lete hain. Reality yeh hai ke yeh loan hota hai, income nahi. Jo log is difference ko samajh lete hain, woh kabhi debt trap mein nahi phansay.

Credit Card Upgrade Kab Aur Kyun Karna Chahiye

Beginners aksar jaldi upgrade ki sochne lagte hain. Upgrade tab meaningful hota hai jab:

- 9–12 mahine ka clean repayment record ho

- Credit limit ka responsible use hua ho

- Income stable aur documented ho

Bina foundation ke upgrade sirf stress aur charges barhata hai.

Beginners Ke Liye Common Credit Card Mistakes

- Sirf minimum payment karna

- Limit ka 80–100% use karna

- Cash withdrawal ko normal samajhna

- Har offer par swipe kar dena

- Due date ignore karna

In mein se ek ghalti bhi beginner ke liye long-term problem ban sakti hai.

Beginner Credit Card Mistakes

| Beginner Mistake | Log Kya Samajhte Hain | Asal Nuksaan |

| Sirf minimum payment karna | “Baad mein clear kar lenge” | Interest barhta jata hai |

| Credit limit full use karna | “Limit hai to use bhi kar sakte hain” | Credit profile weak hoti hai |

| Cash advance lena | “Emergency mein theek hai” | Heavy charges + markup |

| Due date ignore karna | “1–2 din se kuch nahi hota” | Late fee + record damage |

| Multiple cards apply karna | “Jahan mil jaye le lo” | Rejections + trust loss |

| Offers ke chakkar mein swipe | “Discount mil raha hai” | Overspending habit |

| Statement check na karna | “Bank khud manage kar lega” | Errors notice nahi hotay |

| Credit card ko income samajhna | “Extra paisa hai” | Debt trap start hota hai |

Quick Reminder:

Beginner ke liye sab se mehngi ghalti discipline ki kami hoti hai, income ki nahi.

Secured vs Unsecured Credit Card – Simple Comparison

Beginners aksar yeh nahi samajh paate ke secured aur unsecured credit card mein asal farq kya hota hai, aur kaunsa un ke liye zyada safe hai.

| Feature | Secured Credit Card | Unsecured Credit Card |

| Deposit Required | Haan (fixed amount) | Nahi |

| Approval Chances | Bohot zyada | Income par depend |

| Credit Limit | Deposit ke barabar | Bank decide karta hai |

| Risk Level | Low | Medium–High |

| Beginner Friendly | ⭐⭐⭐⭐⭐ | ⭐⭐⭐ |

| Overspending Risk | Kam | Zyada |

| Credit History Build | Strong aur safe | Strong but risky |

| Best For | First-time users | Experienced users |

Secured credit card beginners ke liye training wheel jaisa hota hai. Yeh aap ko credit system samjhata hai bina zyada risk ke. Jab discipline aur payment record strong ho jata hai, tab unsecured card par move karna zyada logical hota hai.

Unsecured credit card beginners ke liye tabhi theek hota hai jab income stable ho aur spending control already strong ho.

Agar pehla credit card hi ghalat handle ho jaye, to aage ja kar loan, financing aur limits sab mushkil ho jati hain. Isi liye beginner ke liye simple card + secured approach + discipline sab se safe formula hota hai.

Pakistan mein credit card apply karne ka tareeqa – Credit card success ka raaz zyada features mein nahi, zyada control mein hota hai.

Frequently Asked Questions (FAQs)

Pakistan mein credit card kaun apply kar sakta hai?

Jo legal age ka ho aur income criteria meet karta ho.

Student credit card mil sakta hai?

Generally nahi, jab tak income proof na ho.

Credit card approval kitni dair mein hota hai?

Aksar 7–14 working days.

Kya credit card interest-free hota hai?

Sirf tab jab full payment time par ho.

Minimum payment karna safe hai?

Short-term mein haan, long-term mein mehnga.

Credit card cash nikalna theek hai?

Avoid karna behtar hota hai.

Business walon ko credit card mil jata hai?

Haan, agar documents strong hon.

Credit limit barh sakti hai?

Haan, responsible usage ke baad.

Credit card band karna mushkil hota hai?

Nahi, request par close ho jata hai.

Credit card credit score improve karta hai?

Haan, agar sahi use ho.

Ek se zyada credit card rakh sakte hain?

Haan, lekin beginners ke liye recommended nahi.

Credit card late payment ka nuksaan kya hai?

Extra charges aur credit score damage.

Credit card apply karne ki best time kya hai?

Jab income stable ho.

Online apply karna safe hai?

Haan, agar official bank website ho.

Credit card reject ho jaye to dobara apply kab karein?

Income ya profile improve karne ke baad.

See also:

- Credit Card Kaise Banta Hai Pakistan Mein? (2026 Secret Approval Guide and Rejection Reasons)

- Credit Card Fraud Protection Pakistan – How People Lose Money Without Knowing

- Best Credit Card for Online Shopping Pakistan and Which One Is Safe for Online Shopping?

- Freelancing Scams in Pakistan – Kyun Aksar Beginners Confuse Ho Jate Hain

- Online Earning in Pakistan Reality – Real Ways Aur Dangerous Traps Ka Complete Reality Check

- Best Investment Plan in Pakistan (2026) – Safe Aur Risky Options Ka Clear Comparison

Conclusion of Pakistan Mein Credit Card Apply Karne ka Tareeqa

Pakistan mein credit card apply karna mushkil nahi, lekin samajh ke apply karna bohot zaroori hai.

Credit card ek powerful financial tool hai jo convenience, emergency support aur credit history build karne mein madad karta hai — lekin sirf tab jab use discipline ke sath use kiya jaye.

Jo log eligibility samajh kar, sahi card choose kar ke aur responsible usage ke sath credit card lete hain, un ke liye yeh ek benefit ban jata hai.

Jo log bina planning ke apply aur use karte hain, un ke liye yahi cheez tension ka sabab ban sakti hai. Decision aapka hai — tool same rehta hai, result usage se decide hota hai.