Introduction

Pakistan mein investment ka matlab 2026 mein sirf paisa lagana nahi raha, balkay paisa bachana, protect karna aur samajhdari se grow karna ban chuka hai.

Mehngai, currency pressure aur economic uncertainty ki wajah se log aksar confusion ka shikar ho jate hain — koi kehta hai bank best hai, koi gold recommend karta hai, aur koi high-return schemes ki taraf le jata hai. Masla yeh hai ke har shakhs ke paas same amount, same risk tolerance aur same goals nahi hotay.

Kuch log 50,000 se start karna chahte hain, kuch ke paas 100,000 hotay hain, aur kuch 500,000 ya us se zyada amount invest karna chahte hain. Lekin aksar guides yeh clear nahi kartin ke kis amount ke liye kaunsa plan zyada practical hota hai.

Is best investment plan Pakistan guide ka maqsad yeh hai ke investment ko theory ke bajaye real-life decision ke taur par samjhaya jaye.

Yahan sirf “best investment” ka claim nahi kiya ja raha, balkay yeh bataya ja raha hai ke kis amount par kaunsa option realistic, safe aur sustainable hota hai — aur kahan risk lena chahiye aur kahan nahi.

Yeh best investment plan Pakistan guide un logon ke liye hai jo short-term hype ke bajaye long-term clarity chahte hain.

Pakistan Mein Investment Confusion Kyun Barh Rahi Hai

Pakistan mein mehngai, currency fluctuation aur economic uncertainty ki wajah se logon ke liye paisa sirf kamana hi kaafi nahi raha. Ab asal challenge yeh hai ke jo paisa hai, usay kaise protect aur grow kiya jaye.

Log aksar savings account mein paisa rakh dete hain aur samajhte hain ke woh safe hai, jab ke asal mein inflation unki savings ko dheere dheere kha rahi hoti hai.

Doosri taraf kuch log bina proper understanding ke risky investments mein chalay jate hain, jahan short-term profit ke chakkar mein capital bhi daav par lag jata hai.

Is liye 2026 ke liye investment plan banate waqt sab se pehla step yeh samajhna hai ke safe aur risky investment ka matlab kya hota hai, aur kaunsa option kis type ke investor ke liye sahi hota hai.

Investment Karne Se Pehle Apni Financial Reality Samajhna

Risk Tolerance Kya Hoti Hai

Har shakhs ka risk lene ka level alag hota hai. Koi banda thora sa nuksaan bardasht kar sakta hai, jab ke koi apni principal amount ka halka sa risk bhi nahi lena chahta. Investment plan choose karne se pehle apna yeh sawal clear karna bohot zaroori hota hai.

Investment Ka Maqsad Clear Hona Chahiye

Kya paisa short-term mein grow karna hai ya long-term ke liye secure karna hai? Kya yeh retirement ke liye hai, bachon ke future ke liye hai, ya sirf inflation se bachne ke liye? Jab tak maqsad clear na ho, sahi investment choose karna mushkil rehta hai.

Safe Investments Kya Hoti Hain – Asaan Alfaaz Mein

Safe Investment Ka Basic Concept

Safe investments wo hoti hain jahan capital loss ka risk bohot kam hota hai. Profit shayad zyada na ho, lekin paisa relatively secure rehta hai. Pakistan jaise mulk mein jahan economic cycles unpredictable hote hain, safe investments ka role bohot important ho jata hai.

Pakistan Mein Sab Se Zyada Popular Safe Investment Options (2026)

National Savings Schemes

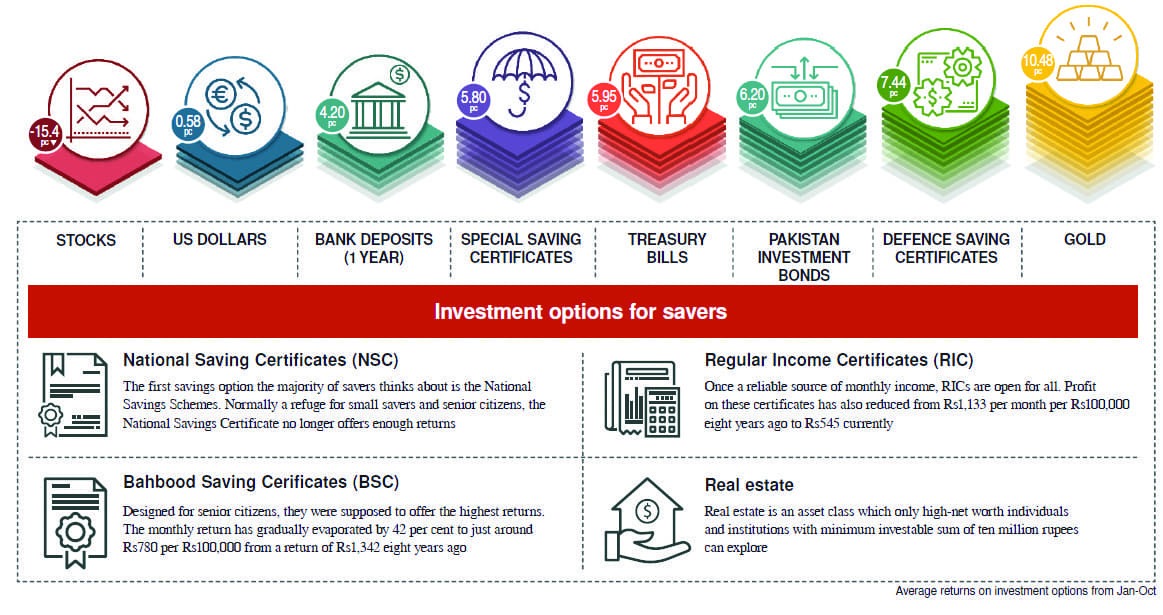

National Savings certificates Pakistan mein decades se logon ka trust jeetay huay hain. Inka sab se bara faida yeh hota hai ke yeh government backed hotay hain, is liye default ka risk bohot kam hota hai. Returns fixed hoti hain aur monthly ya quarterly income ka option bhi milta hai.

Bank Term Deposits

Fixed deposits un logon ke liye behtar hote hain jo risk nahi lena chahte. Lekin 2026 mein ek important baat yeh hai ke bank return aksar inflation se kam hota hai, is liye real growth limited rehti hai.

Government Bonds aur Sukuk Bonds

Pakistan mein government bonds aur Sukuk comparatively safe investment samjhe jate hain. Inka faida yeh hota hai ke yeh interest ya profit rate pehle se defined hota hai, aur maturity par principal amount wapas mil jati hai.

Safe Investment Returns – Reality Check Table

| Investment Type | Risk Level | Expected Return (2026) |

| National Savings | Low | Medium |

| Fixed Deposit | Low | Low to Medium |

| Govt Bonds | Low | Medium |

| Savings Account | Very Low | Very Low |

Risky Investments Kya Hoti Hain

Risk Ka Matlab Sirf Loss Nahi Hota

Risky investment ka matlab yeh nahi ke har dafa nuksaan hi hota hai. Iska matlab hota hai ke returns guaranteed nahi hotay. Kabhi profit zyada ho sakta hai aur kabhi loss bhi ho sakta hai. Risk aur reward ka seedha relation hota hai.

Pakistan Mein Popular Risky Best Investment Plan Pakistan Options (2026)

Stock Market

Stock market Pakistan mein sab se zyada misunderstood investment hai. Log ya to isay gambling samajhte hain ya phir overnight ameer banne ka zariya. Reality yeh hai ke stock market long-term investors ke liye powerful wealth creation tool ho sakta hai, lekin bina knowledge ke yeh bohot risky bhi ho sakta hai.

Real Estate (Short-Term Perspective)

Real estate traditionally safe samjha jata tha, lekin 2026 mein short-term real estate flipping risky ho chuki hai. Prices stagnate ho sakti hain aur liquidity ka issue bhi aa sakta hai.

Gold

Gold ko safe haven samjha jata hai, lekin short-term trading ke liye gold bhi volatile ho sakta hai. Long-term mein gold inflation hedge ka kaam karta hai, lekin guaranteed profit nahi deta.

Crypto Assets

Crypto Pakistan mein abhi bhi high-risk category mein aata hai. Price volatility bohot zyada hoti hai aur regulatory clarity limited hai. Is liye sirf woh log is mein jate hain jo loss afford kar sakte hon.

Safe vs Risky Investments – Simple Comparison

| Factor | Safe Investment | Risky Investment |

| Capital Safety | High | Low to Medium |

| Return Potential | Limited | High |

| Volatility | Low | High |

| Knowledge Requirement | Low | High |

| Stress Level | Low | High |

Balanced Investment Strategy – Dono Ka Mix

Sirf Safe Ya Sirf Risky Kyun Galat Hai

Sirf safe investment rakhne se paisa grow nahi karta, aur sirf risky investment rakhne se capital danger mein aa jata hai. Smart investors hamesha portfolio diversify karte hain.

Example of Balanced Allocation

Agar koi medium risk lene wala investor hai, to woh apna 60% paisa safe options mein aur 40% risky options mein rakh sakta hai. Yeh ratio har shakhs ke risk tolerance ke mutabiq change ho sakta hai.

2026 Mein Investment Karte Waqt Common Mistakes

“Guaranteed High Return” Ka Jaal

Jahan guaranteed high return ka wada ho, wahan risk bhi utna hi zyada hota hai. Real investment duniya mein guaranteed high profit ka concept nahi hota.

Herd Mentality

Log aksar doosron ko dekh kar investment decisions lete hain. Yeh approach aksar nuksaan ka sabab banti hai.

Long-Term Soch Ka Faida

Investment ka asal faida tab nikalta hai jab decision patience ke sath liya jaye. Short-term ups and downs se panic hona investor ko apne hi nuksaan ki taraf le jata hai.

Beginner Investors Ke Liye Step-by-Step Investment Roadmap

Investment Start Karne Se Pehle Ground Rules

Jo log pehli dafa investment ki taraf aa rahe hote hain, unki sab se bari ghalti yeh hoti hai ke woh seedha kisi “best plan” ki talash shuru kar dete hain, jab ke pehla step financial discipline hota hai.

Investment tab kaam karti hai jab emergency fund already separate ho aur daily expenses stable hon. Agar har mahine kharch aur income ka record clear nahi, to investment stress ban jati hai.

Pehla Saal Sirf Learning Ka Rakhein

Beginners ke liye 2026 mein behtar strategy yeh hai ke pehle saal ko learning aur adjustment ka saal samjhein. Is period mein small amounts invest karke system, returns aur apni emotional reaction ko samajhna zyada important hota hai, na ke maximum profit.

Chhoti Raqam Se Investment – 50,000 Se 100,000 Ka Real Plan

Kam Paisay Mein Bhi Start Kyun Zaroori Hai

Bohot se log yeh soch kar wait karte rehte hain ke “jab zyada paisa hoga tab invest karenge”. Reality yeh hai ke investment ka sab se important factor time hota hai, amount nahi. 50,000 ya 100,000 se start karna investor ko habit, confidence aur market understanding deta hai.

Small Amount Allocation Example

Chhoti raqam ke liye behtar hota hai ke paisa ek hi jagah na lagaya jaye. Misal ke taur par, kuch hissa safe savings ya certificates mein aur kuch hissa moderate risk options mein rakhna balanced approach hoti hai.

Inflation Aur Investment Returns – Jo Aksar Ignore Ho Jata Hai

Inflation Ka Asal Nuksaan

Agar investment ka return inflation se kam ho, to technically paisa grow nahi kar raha hota balkay uski purchasing power kam ho rahi hoti hai. Pakistan mein inflation historically high rahi hai, is liye sirf “safe” hone ka matlab hamesha “beneficial” nahi hota.

Real Return Samajhna Kyun Zaroori Hai

Real return ka matlab hota hai investment return minus inflation. Agar bank FD 12% de rahi hai aur inflation 20% hai, to investor asal mein loss mein hai, chahe number paper par positive dikh raha ho.

Monthly Income vs Long-Term Growth – Kaunsa Behtar Hai?

Monthly Income Options Kis Ke Liye Sahi Hain

Monthly income investments un logon ke liye zyada suitable hoti hain jinhein regular cash flow chahiye — jaise retirees ya woh log jo investment se ghar ke expenses cover karna chahte hain. Lekin in options mein capital growth limited hoti hai.

Long-Term Growth Ka Advantage

Long-term growth investments mein patience ka test hota hai, lekin waqt ke sath compounding ka faida milta hai. 2026 ke perspective se jo log 5–10 saal ka horizon rakhte hain, unke liye growth focus zyada logical hota hai.

Middle-Class Investor Ke Liye Practical Investment Soch

Emotional Decisions Se Bachna

Middle-class investors aksar emotional pressure mein investment decisions lete hain — ya to fear se ya phir greed se. Kabhi market giray to panic, aur kabhi koi profit ki story sunein to rush. Dono extremes long-term damage karti hain.

Stability Ko Priority Dena

Middle-class investor ke liye sab se important cheez capital protection hoti hai. Is liye portfolio mein hamesha ek strong safe base hona chahiye, jiske upar growth aur risk ka layer add kiya jaye.

2026 Investment Risk Warnings Jo Ignore Nahi Karni Chahiye

Unregulated Schemes Se Door Rahain

2026 mein bhi “double paisa”, “guaranteed profit” aur “short time high return” jaise claims active rahenge. Jo scheme regulated na ho ya jahan transparency na ho, us se door rehna hi sab se safe decision hota hai.

Over-Diversification Ka Nuksaan

Diversification zaroori hai, lekin har cheez mein thora thora paisa daal dena bhi ghalat ho sakta hai. Zyada spread portfolio ko manage karna mushkil bana deta hai aur returns dilute ho jate hain.

Investment Mindset Jo 2026 Mein Kaam Aata Hai

Investment sirf numbers ka game nahi, balkay mindset ka bhi test hoti hai. Jo investor market noise se door reh kar apni strategy par qaim rehta hai, wahi long-term mein faida uthata hai. Patience, discipline aur realistic expectations — yeh teen cheezein 2026 ke investor ke liye sab se powerful tools hain.

Women Investors Ke Liye Practical Investment Planning (Pakistan – 2026)

Women Investors Ke Liye Example Portfolios (2026)

Low-Risk Women Investor Portfolio (Capital Protection Focus)

| Investment Type | Allocation % | Reason |

| National Savings / Govt-backed schemes | 40% | Capital safe, stable returns |

| Bank savings / term deposit | 25% | High liquidity, emergency ready |

| Gold (physical / savings-based) | 20% | Inflation hedge, long-term stability |

| Cash buffer | 15% | Unexpected needs, zero stress |

Best for:

Women jo pehli dafa invest kar rahi hain, ya jinke liye liquidity aur peace of mind sab se important hai.

Medium-Risk Women Investor Portfolio (Balanced Growth)

| Investment Type | Allocation % | Reason |

| Govt savings / Sukuk type options | 30% | Stable income |

| Mutual funds / equity-linked options | 25% | Long-term growth |

| Gold | 20% | Hedge against inflation |

| Fixed deposit / savings | 15% | Liquidity |

| High-quality growth asset | 10% | Extra return potential |

Best for:

Women jinki income stable hai aur jo 5–10 saal ka investment horizon rakh sakti hain.

Women Ke Investment Decisions Kyun Different Hotay Hain

Pakistan mein women investors aksar different financial realities face karti hain. Kayi cases mein income irregular hoti hai, kahin savings family responsibilities ke sath manage hoti hain, aur kahin risk lene ka margin limited hota hai.

Is liye women ke liye investment ka matlab sirf profit nahi hota, balkay stability, liquidity aur control hota hai.

Women investors ke liye sab se common ghalti yeh hoti hai ke woh ya to bilkul invest nahi karti, ya phir kisi aur ke kehne par bina samjhe paisa laga deti hain. Dono approaches long-term mein nuksaan karti hain.

Women Ke Liye Safe Start Kaise Kiya Jaye

Women investors ke liye 2026 mein best approach yeh hai ke pehle safe aur liquid options se start kiya jaye. Aise investments jahan paisa zaroorat par easily withdraw ho sakay aur jahan daily monitoring required na ho. Is se confidence build hota hai aur financial independence ka sense develop hota hai.

Jab basic understanding aur comfort aa jaye, tab dheere dheere moderate-risk options add kiye ja sakte hain. Is tarah investment stress nahi banti balkay empowerment ka zariya ban jati hai.

Women Aur Long-Term Security

Women ke liye long-term planning aur bhi zyada important hoti hai, khaaskar jab career breaks, health expenses ya family dependency ka factor ho. Is liye sirf short-term profit ke peechay bhaagna behtar strategy nahi hoti. Balanced portfolio jo time ke sath grow kare aur inflation ko beat kare, women investors ke liye zyada suitable hota hai.

Control Aur Transparency Kyun Zaroori Hai

Women investors ko chahiye ke har investment ka record khud rakhein, chahe amount chhota hi kyun na ho. Transparency aur self-control se na sirf paisa secure rehta hai balkay decision-making bhi strong hoti hai. Yeh approach women ko kisi par depend hone ke bajaye financially confident banati hai.

Halal vs Conventional Investment – Pakistan Mein Asaan Aur Clear Samajh

Halal Aur Conventional Ka Farq Kahan Se Start Hota Hai

Pakistan mein bohot se investors is confusion ka shikar rehte hain ke kaunsa investment halal hai aur kaunsa conventional. Basic level par farq earning mechanism ka hota hai, na ke sirf return ka.

Agar profit fixed ho aur lending-based ho, to woh conventional category mein aata hai. Agar profit business activity ya asset-based ho, to usay halal category mein consider kiya jata hai.

Yahan ek common ghalti yeh hoti hai ke log sirf naam ya label dekh kar decision le lete hain, jab ke asal cheez structure hoti hai.

Halal Investment Options Ka Practical Angle

Halal investment ka matlab yeh nahi ke returns kam ho jate hain. Is ka matlab hota hai ke returns ka source transparent aur asset-backed hota hai.

Pakistan mein 2026 ke context mein halal investment options stable bhi hain aur growth potential bhi rakhte hain, lekin unhein samajhna zaroori hota hai.

Halal investments aksar long-term mindset ke sath zyada achi perform karti hain, kyun ke inka focus speculation ke bajaye real economic activity par hota hai.

Conventional Investments Kab Consider Ki Jati Hain

Conventional investments zyada flexible aur widely available hoti hain. Inmein liquidity aur variety ka faida hota hai, lekin investor ko yeh samajhna hota hai ke risk aur return ka balance kaise manage karna hai. 2026 mein conventional options short-term traders ke liye attractive ho sakti hain, lekin long-term investors ke liye planning zaroori hoti hai.

Decision Kaise Lein – Confusion Ke Bagair

Halal vs conventional ka decision fear ya pressure par nahi hona chahiye. Behtar approach yeh hai ke investor apni values, risk tolerance aur financial goals ko samajh kar choice kare. Jo investor clarity ke sath decision leta hai, wahi long-term mein confident rehta hai — chahe option halal ho ya conventional.

Mixed Portfolio Ka Option

Pakistan mein bohot se investors mixed approach follow karte hain jahan core portfolio stable aur compliant hota hai, aur chhota sa portion flexible investments ke liye rakha jata hai. Yeh approach un logon ke liye kaam karti hai jo balance chahte hain aur extreme decisions se bachna chahte hain.

Halal vs Conventional Investment – Clear Comparison Table

| Factor | Halal Investment | Conventional Investment |

| Profit Source | Business / asset based | Lending / interest based |

| Risk Sharing | Shared risk & reward | Mostly fixed return |

| Transparency | Structure-driven | Contract-driven |

| Return Pattern | Variable, performance based | Mostly fixed |

| Speculation Level | Generally lower | Can be higher |

| Long-Term Stability | Strong | Depends on market |

| Popular Use Case | Long-term planning | Short-term flexibility |

| Emotional Comfort | High for values-focused investors | High for return-focused investors |

Bottom Line:

Halal investments structure par focus karti hain, jab ke conventional investments flexibility aur speed par. Decision ka base clarity hona chahiye, fear nahi.

Best Investment for 50,000 (Beginner Friendly)

| Investment Option | Risk Level | Kyun Suitable Hai |

| Govt-backed savings / certificates | Low | Capital protection, simple start |

| Gold (small quantity) | Medium | Inflation hedge |

| Bank savings | Very Low | High liquidity |

| Learning-based investment | Low | Knowledge build hoti hai |

Reality Check:

50,000 ka matlab yeh nahi ke return kam hoga, balkay yeh amount investment habit aur discipline build karne ke liye best hota hai.

Best Investment for 100,000 (Balanced Start)

| Investment Option | Risk Level | Kyun Suitable Hai |

| Govt savings / Sukuk type | Low | Stable base |

| Mutual fund / growth asset | Medium | Long-term growth |

| Gold | Medium | Risk balance |

| Emergency cash | Very Low | Flexibility |

Reality Check:

100,000 se investor diversification samajh sakta hai aur safe + growth ka mix bana sakta hai.

Best Investment for 500,000 (Serious Planning)

| Investment Option | Risk Level | Kyun Suitable Hai |

| Govt bonds / savings | Low | Capital stability |

| Equity / growth-focused assets | Medium–High | Wealth creation |

| Gold | Medium | Hedge |

| Cash buffer | Low | Opportunity fund |

Reality Check:

500,000 par sab se bari ghalti yeh hoti hai ke paisa ek hi jagah daal diya jaye. Is level par portfolio approach zaroori hoti hai.

Frequently Asked Questions (FAQs) for Best Investment Plan Pakistan

Pakistan mein sab se safe investment kaunsa hai?

National Savings aur government bonds relatively sab se safe hain.

Kya stock market bilkul unsafe hai?

Nahi, long-term aur knowledge ke sath safe ho sakta hai.

Gold 2026 mein behtar option hai?

Inflation hedge ke liye theek hai, growth ke liye limited.

Real estate abhi invest karna chahiye?

Long-term view ke sath, haan. Short-term flipping risky hai.

Crypto investment legal hai?

Regulatory clarity limited hai, risk high hai.

Bank FD inflation ko beat karti hai?

Aksar nahi.

Beginner investor kahan se start kare?

Safe options se start karna behtar hota hai.

Monthly income ke liye best option?

National Savings income schemes.

Investment mein diversification kyun zaroori hai?

Risk ko spread karne ke liye.

Kya ek hi investment plan sab ke liye sahi hota hai?

Nahi, har shakhs ka profile alag hota hai.

2026 mein sab se zyada risky investment kya hai?

High leverage aur unregulated schemes.

Kya small amount se investment possible hai?

Haan, mutual funds aur savings schemes se.

Investment ka best time kab hota hai?

Jab planning clear ho, na ke market hype ke time.

Loss ho jaye to kya karein?

Emotionally react na karein, analysis karein.

Investment aur saving mein farq kya hai?

Saving paisa rakhna hai, investment paisa grow karna hai.

Kya women ke liye alag investment rules hotay hain?

Rules alag nahi, lekin priorities alag hoti hain. Women investors ke liye liquidity aur stability zyada important hoti hai.

Agar income irregular ho to investment possible hai?

Haan, irregular income ke sath bhi flexible aur low-commitment investments possible hoti hain.

Kya chhoti amount se halal investment start ho sakti hai?

Bilkul. Amount se zyada important consistency aur structure hota hai.

Kya halal investments slow hoti hain?

Slow ka matlab stable hota hai. Long-term mein yeh consistency bohot strong result deti hai.

Kya women investors ko risky investments avoid karni chahiye?

Avoid nahi, limit karni chahiye. Risk manage karna ghalat nahi hota.

Gold halal category mein aata hai?

Gold agar asset ke taur par hold kiya jaye to halal consider hota hai.

Kya conventional investment har case mein ghalat hoti hai?

Nahi, yeh investor ke goals aur understanding par depend karta hai.

Mixed portfolio rakhna theek hai?

Haan, agar core portfolio stable ho aur risky portion limited ho.

Kya women investors ko independent accounts rakhne chahiye?

Strongly recommended. Control aur clarity dono ke liye zaroori hai.

Kya halal investment returns kam hotay hain?

Returns kam nahi hotay, volatility kam hoti hai.

Kya monthly income halal investments se possible hai?

Haan, lekin focus sustainability par hota hai, instant high cash flow par nahi.

Kya long-term halal investments inflation ko beat kar sakti hain?

Proper planning ke sath, haan.

Kya beginners ke liye halal investment complicated hoti hai?

Nahi, agar structure samajh liya jaye to simple hoti hai.

Kya women investors ko financial advisor ki zarurat hoti hai?

Agar amount aur complexity barh jaye to professional guidance helpful hoti hai.

Sab se common mistake kya hoti hai?

Emotion ke basis par decision lena — ya fear se ya pressure se.

See also:

Mobile Se Online Earning Kaise Karein? Zero Investment Beginner Guide 2026

Online Fraud Prevention Pakistan – New Scams Targeting Families and Freelancers

Best Savings Account Pakistan in 2026 – Profit, Risks and Reality

How to Save Money in Pakistan (Without Unrealistic Advice)

Complete Guide to Best Life Insurance Pakistan 2026

Conclusion of Best Investment Plan Pakistan

Pakistan mein 2026 ke liye best investment plan ka matlab sirf “sab se zyada return” dhoondhna nahi hai, balkay risk aur safety ka balanced decision lena hai. Safe investments paisay ko protect karti hain, jab ke risky investments paisay ko grow karne ka moka deti hain. Samajhdari isi mein hai ke dono ka sahi mix banaya jaye.

Har investor ka journey alag hota hai. Jo cheez ek shakhs ke liye best hai, zaroori nahi ke doosre ke liye bhi wahi ho. Is liye investment decision hamesha apni financial situation, risk tolerance aur long-term goals ko samajh kar lena chahiye. Planning ke sath ki gayi investment hi future ko secure banati hai.

Disclaimer: Investment Risk Disclaimer 2026

Yeh guide educational aur informational purpose ke liye tayar ki gayi hai. Investment returns market conditions, economic changes aur individual decisions par depend karte hain. Koi bhi investment bilkul risk-free nahi hoti, aur past performance future results ki guarantee nahi hoti. Har reader ko chahiye ke investment decision lene se pehle apni financial situation, risk tolerance aur long-term goals ko samjhe.