Pakistan mein credit card apply karna asaan lagta hai — lekin asal masla approval ka hota hai. Har saal hazaaron log correct documents ke bawajood sirf choti si mistake ki wajah se reject ho jate hain.

Pakistan mein 80% credit card applications sirf choti mistakes ki wajah se reject ho jati hain — yeh guide woh mistakes avoid karne ke liye hai.

Kabhi income proof issue, kabhi bank criteria mismatch, aur kabhi galat card choose karna.

Pakistan mein aksar log yeh poochte hain ke credit card kaise banta hai Pakistan mein, aur kaun se factors approval ya rejection ka faislah karte hain.

Is credit card kaise banta hai Pakistan mein guide mein hum sirf yeh nahi batayenge ke credit card kaise banta hai, balkay yeh bhi clear karein ge:

- Credit card reject kyun hota hai

- Pehli attempt mein approval kaise barhta hai

- 2026 mein banks kis cheez ko zyada importance dete hain

Credit Card Pakistan Mein Kya Hota Hai Aur Log Kyun Apply Karte Hain

Pakistan mein credit card aik aisa financial tool hai jo bank aapko aik limit deta hai, jiske andar reh kar aap shopping, bill payments, online subscriptions, aur emergency expenses cover kar sakte hain.

Agar aap samajhna chahte hain ke credit card kaise banta hai Pakistan mein, to sab se pehle bank eligibility aur income criteria clear hona zaroori hota hai.

Iska sab se bara faida yeh hota hai ke aap turant payment kar sakte hain aur baad mein bank ko installment ya full payment mein amount wapas kar dete hain.

Lekin masla yeh hai ke bohot se log apply karte hain aur unki application reject ho jati hai — kyunke unhein sahi process, eligibility aur hidden rules ka pata nahi hota.

Is guide ka maqsad yahi hai ke aapko bank ke angle se sochna sikhaya jaye, taake approval chances maximum ho jaen.

Pakistan Mein Credit Card Banane Ke Liye Basic Eligibility

Pakistan ke tamam banks kuch common criteria follow karte hain, chahe aap kisi bhi bank se credit card apply karein.

Age Requirement Kya Hoti Hai

Aksar banks ke liye minimum age 21 saal hoti hai aur maximum 60 saal. Salary card ya secured card ke liye kabhi kabhi upper age limit thori flexible ho sakti hai.

Income Requirement Ka Sach

Income requirement bank-to-bank different hoti hai, lekin generally:

- Salaried person ke liye minimum monthly income 40,000 se 60,000 PKR

- Business/self-employed ke liye stable monthly inflow proof zaroori hota hai

Sirf salary keh dena kaafi nahi hota — bank income ki consistency check karta hai.

Credit History Kyun Itni Important Hai

Agar aap pehle kisi bank ka loan, mobile financing, ya installment plan le chuke hain aur timely payment ki hai, to yeh aapke liye plus point hota hai. Agar kabhi default hua ho, to approval mushkil ho jati hai.

Income-Based Credit Card Recommendation Table (Pakistan)

Income ke mutabiq sahi credit card choose karna approval ka sab se strong factor hota hai. Yeh table aapko clearly batata hai ke income ke hisaab se kaunsa credit card type aur bank zyada realistic hota hai — is se wrong applications aur rejection rate kam hota hai:

| Monthly Income (PKR) | Recommended Card Type | Best Bank Options | Reason / Notes |

| 40,000 – 60,000 | Basic / Classic Credit Card | Allied, MCB, Alfalah | Low limit, asaan approval, beginners ke liye safe |

| 60,000 – 100,000 | Gold Credit Card | HBL, StanChart, Allied | Balanced limit, rewards, better acceptance |

| 100,000 – 200,000 | Platinum Credit Card | StanChart, HBL, Alfalah | High limit, travel & lifestyle benefits |

| 200,000+ | Premium / World Card | StanChart, BOP | Maximum perks, lounges, higher scrutiny |

| Irregular / Freelance Income | Secured Credit Card | Alfalah, MCB | Fixed deposit ke against issue hota hai |

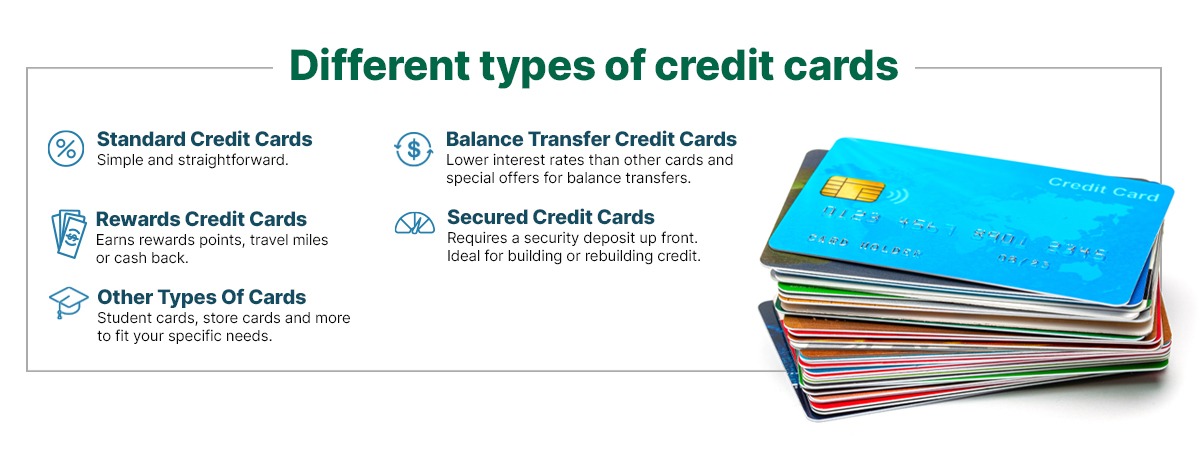

Credit Card Ke Types Jo Pakistan Mein Available Hain

Har credit card same nahi hota. Aksar log yahin ghalti karte hain ke wrong type ke liye apply kar dete hain.

Classic / Standard Credit Card

Yeh beginners ke liye hota hai. Limit kam hoti hai lekin approval chances zyada hotay hain.

Gold Credit Card

Is mein limit zyada hoti hai aur kuch extra benefits milte hain jaise discounts aur lounge access (limited).

Platinum / Titanium Credit Card

High income aur strong credit profile walon ke liye hota hai. Iske liye bank bohot strict checking karta hai.

Secured Credit Card (Deposit Ke Against)

Agar aapki income kam hai ya credit history nahi hai, to yeh best option hota hai. Bank aapse fixed deposit leta hai aur uske against credit card issue karta hai.

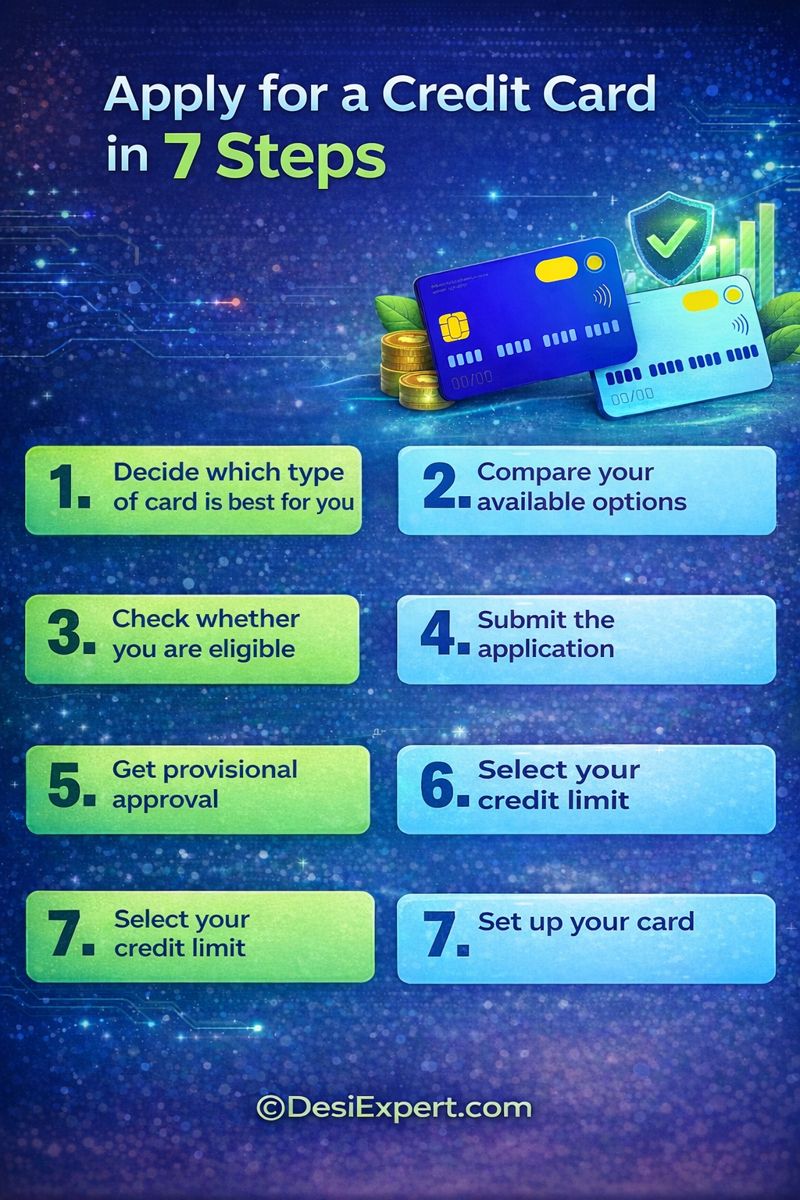

Credit Card Apply Karne Ka Step-by-Step Process Pakistan Mein

Yahan woh process explain kiya ja raha hai jo practically banks follow karte hain.

Step 1: Sahi Card Select Karna

Sab se pehle apni income, expenses aur usage samjhein. Sirf naam dekh kar Platinum card ke liye apply karna aksar rejection ka sabab banta hai.

Step 2: Documents Tayaar Karna

Bank incomplete documents par application aage hi nahi bhejta.

Step 3: Application Form Fill Karna

Form mein di gayi information bilkul CNIC aur bank record se match honi chahiye. Chhoti si mismatch bhi delay ya rejection la sakti hai.

Step 4: Bank Verification Call Aur Visit

Bank aapko call karta hai, kabhi office ya ghar ka verification hota hai. Is step mein ghalat jawab approval khatam kar sakta hai.

Step 5: Approval Aur Card Delivery

Approval ke baad card courier ke zariye aata hai, aur activation call ke baad usable hota hai.

Credit Card Ke Liye Required Documents (Updated 2026)

| Applicant Type | Required Documents |

| Salaried | CNIC copy, salary slip (last 2–3 months), bank statement |

| Business | CNIC, bank statement (6 months), business proof |

| Secured Card | CNIC, fixed deposit proof |

Credit Card Approval Chances Kaise Barhayein

Yeh woh cheezein hain jo banks openly nahi batate.

Apna Bank Account Active Rakhein

Dead ya low-activity account se apply karne par bank risk samajhta hai.

Income Se Zyada Limit Demand Na Karein

Zyada limit maangna red flag hota hai. Bank pehle aapko test karta hai.

Multiple Banks Mein Same Time Apply Na Karein

Yeh cheez aapki credit profile ko negative impact karti hai.

Pakistani Bank Credit Card Features (Verified Examples)

Standard Chartered Pakistan

Offers a range of credit cards including cashback, travel, and lifestyle benefit cards. Standard Chartered

Some cards give airport lounge access, dining & retail discounts, reward points. Standard Chartered

HBL (Habib Bank Ltd.)

HBL credit cards include Platinum, Gold, Green & FuelSaver variants. HBL

They have different income eligibility based on card level (e.g., Platinum needs higher salary). HBL

You can also apply online or via mobile app under select conditions. HBL

MCB (Muslim Commercial Bank)

Offers an easy online credit card application process directly on its official site. MCB Bank

Bank Alfalah

Allows applying for “Instant Credit Card” through mobile banking in minutes without branch visit or paperwork for eligible customers. Bank Alfalah

Allied Bank

Lists Visa Gold and Platinum cards with rewards and global acceptance. Allied Bank

Bank of Punjab

BOP offers several types like Gold, Platinum, World, and Green cards, and explains annual fees and activation methods in FAQs. BOP

Standard Chartered Eligibility Example (General)

Age: typically 21–60 for salaried and 25–65 for self-employed.

Minimum monthly income requirements (e.g., PKR 25,000+ for salaried). forms.online.standardchartered.com

Pakistani Bank Comparison Table (2026)

| Bank | Example Card Types | Known Eligibility Highlights | Benefits & Notes |

|---|---|---|---|

| Standard Chartered | Titanium, World, Cashback, Easy Credit | Generally 21–60 yrs; min income ~PKR 25,000+ (varies by card) forms.online.standardchartered.com | Lounge access, dining/retail offers, rewards Standard Chartered |

| HBL | Platinum, Gold, FuelSaver, Green | Income & balance requirements differ by card HBL | Travel rewards, fuel/cashback, online application options HBL |

| Bank Alfalah | Instant Credit Card variants | Apply via app quickly, minimal physical docs Bank Alfalah | Fast issuance, multiple card types Bank Alfalah |

| MCB | Online Credit Card | Standard application online | Quick apply and status check MCB Bank |

| Allied Bank | Visa Gold, Visa Platinum | Typical bank eligibility applies | Rewards, global acceptance Allied Bank |

| Bank of Punjab (BOP) | Gold, Platinum, World, Green | Standard docs & income | Variable annual fees, multiple payment options BOP |

Quick Comparison Chart: Credit Card Perks (Pakistan Banks)

| Perks / Bank | StanChart | HBL | Alfalah | MCB | Allied | BOP |

|---|---|---|---|---|---|---|

| Rewards & Cashback | ⭐⭐⭐⭐ | ⭐⭐ | ⭐⭐⭐ | ⭐⭐ | ⭐⭐⭐ | ⭐⭐ |

| Travel / Lounge Access | ⭐⭐⭐⭐ | ⭐⭐⭐ | ⭐⭐ | ⭐⭐ | ⭐⭐ | ⭐⭐ |

| Easy Online Application | ⭐⭐⭐ | ⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐ | ⭐⭐ |

| Mobile App Application | ⭐⭐⭐ | ⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐ | ⭐⭐ | ⭐⭐ |

| Instant Card Option | ⭐⭐ | ⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐ | ⭐⭐ | ⭐⭐ |

Below is a simplified chart you could include in your article to visually compare benefits:

⭐ Rating Guide

⭐⭐⭐⭐ = Feature strong aur commonly available

⭐⭐⭐ = Feature available lekin limited cases mein

⭐⭐ = Feature rare ya selected customers ke liye

(Note: Ratings are illustrative based on common offerings among banks in Pakistan.)

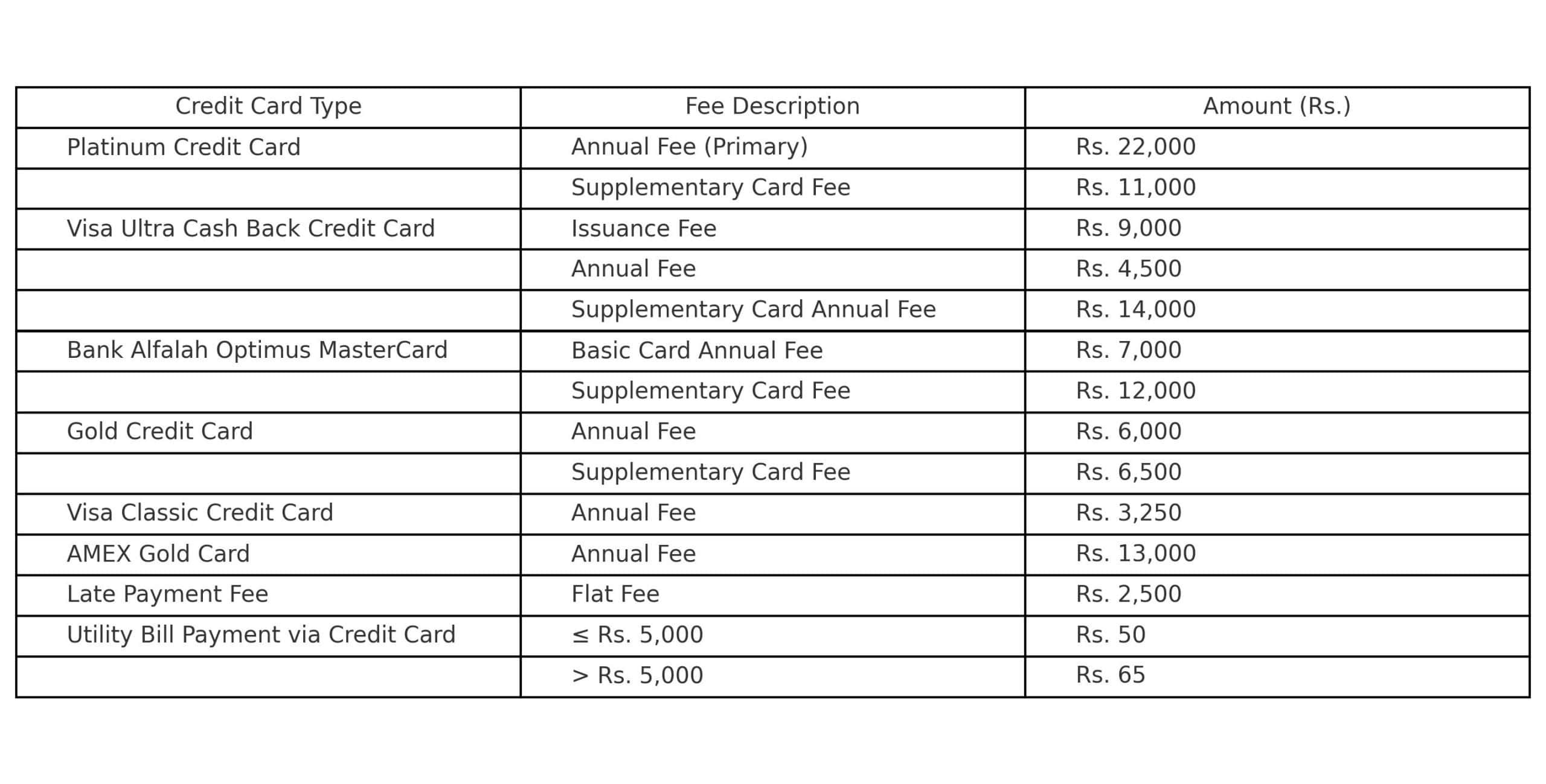

Credit Card Fees Aur Charges Jo Aksar Ignore Ho Jate Hain

| Charge Type | Average Range |

| Annual Fee | 3,000 – 12,000 PKR |

| Late Payment Fee | 1,000 – 2,000 PKR |

| Cash Withdrawal Fee | 5–7% |

Pakistan Mein Credit Card Use Karne Ke Smart Rules

Credit card loan nahi hota, agar discipline ke sath use na ho to financial pressure ban jata hai.

Full Payment Habit Banayein

Minimum payment trap hota hai jo interest mein phansa deta hai.

Cash Withdrawal Avoid Karein

ATM se cash nikalna sab se mehnga option hota hai.

Credit Card Aur Debit Card Mein Basic Difference

| Feature | Credit Card | Debit Card |

| Bank ka paisa | Yes | No |

| Interest | Yes | No |

| Credit history | Build hoti hai | Nahi |

Credit Card Rejection Ki Common Wajahen

- Income proof weak hona

- Credit history negative hona

- Over-application

- Wrong information dena

Pakistan Mein Kon Sa Credit Card Kiske Liye Best Hota Hai

Credit card choose karte waqt sabse zaroori cheez yeh samajhna hota hai ke aapka financial lifestyle kaisa hai. Har card har insaan ke liye best nahi hota. Isi liye sab se pehle apni zaroorat clear kar lein.

Agar aap salary person hain aur routine grocery, fuel aur online payments ke liye card chahte hain, to basic aur standard cards best option hotay hain. Inki limit kam hoti hai lekin approval relatively asaan hoti hai.

Jab aap financially stable ho jate hain aur usage history build ho jati hai, tab platinum ya premium card lena samajhdari hoti hai.

Business walon ke liye credit card ka benefit aur bhi important hota hai kyunke business payments ko manage karna, foreign expenses handle karna aur cashflow maintain karna credit card se asaan ho jata hai.

Lekin iske liye bank income documents, tax filing aur strong bank statement dekh kar hi approval deta hai.

Credit Card Approval Process Mein Time Aur Steps + Simple Chart

Yeh chart readers ko ek quick overview deta hai ke application se le kar approval tak total journey kaise hoti hai:

Credit Card Approval Journey Pakistan Mein

| Step | Action | Expected Time |

|---|---|---|

| 1 | Card type aur bank select karna | 1–2 days |

| 2 | Documents collect aur form submit karna | 1–3 days |

| 3 | Bank verification (home/office) | 2–7 days |

| 4 | Final approval decision | 3–10 days |

| 5 | Card printing aur delivery | 5–14 days |

| 6 | Activation aur first use | Same day |

Is chart se ek cheez clear hoti hai ke normally credit card banne mein tep se delivery tak 10 se 25 din lag jate hain. Agar documents incomplete hon ya verification mein koi issue ho, to yeh time aur barh sakta hai.

Pakistan Mein Top Credit Cards Ka Detailed Comparison (Features Wise)

Neeche detailed comparison table diya gaya hai jisme Pakistan ke kuch famous credit card types ki basic features compare ki gayi hain—taake reader easily decide kar sake.

Pakistan Top Credit Cards Detailed Comparison

| Feature | Basic / Classic Card | Gold Credit Card | Platinum / Premium Card |

|---|---|---|---|

| Eligibility | Stable income aur basic documents | Higher salaried ya strong statement | High income, strong credit score |

| Annual Fee | Low–Medium | Medium | Medium–High |

| Credit Limit | Low | Medium | High |

| Rewards & Cashback | Limited | Good | Excellent |

| Lounges / Travel Benefits | Rare | Some | Multiple |

| Approval Difficulty | Easy–Medium | Medium | Hard |

| Suitable For | New users aur low expenses | Average income users | Frequent travellers, high spenders |

Yeh table is liye important hai kyunke aksar log platinum ya premium card ka naam sunn kar confuse ho jate hain aur apply kar dete hain bina requirement samjhe.

Jab approval nahi hota, to wo sochte hain ke bank unfair hai. Jabke asal cheez eligibility mismatch hoti hai.

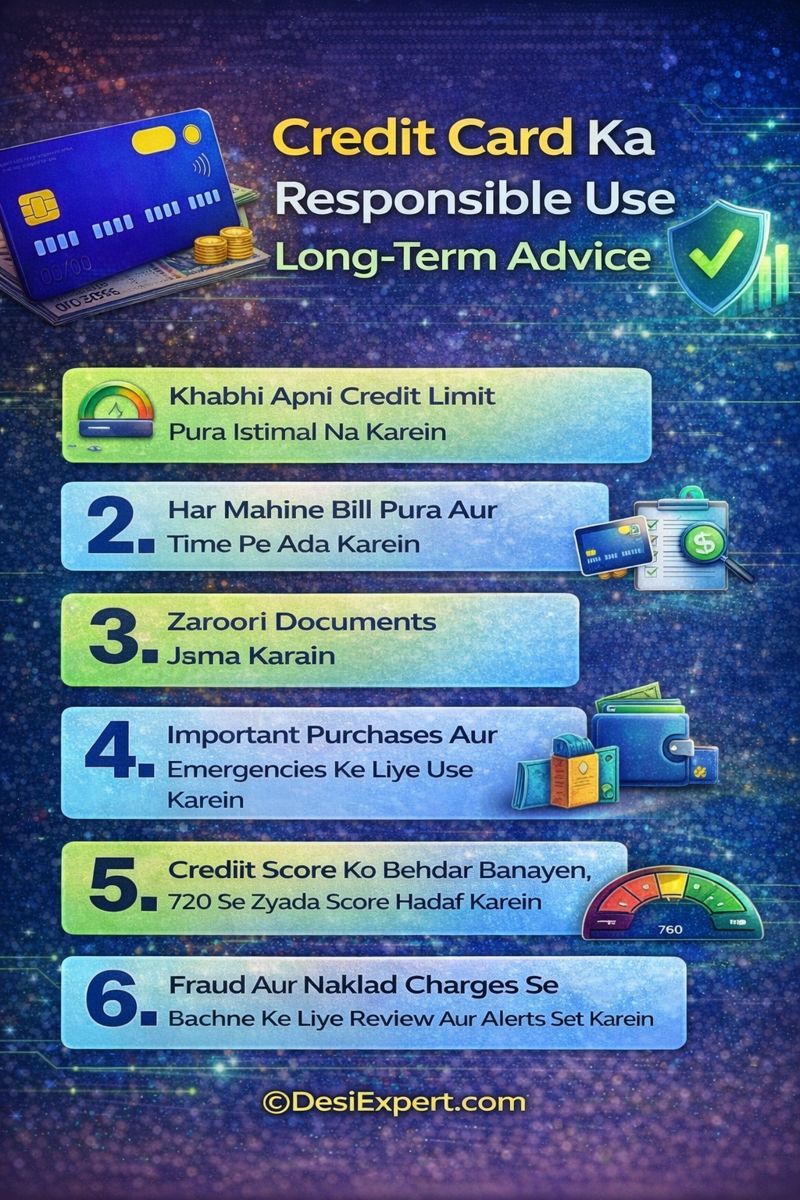

Credit Card Ka Responsible Use – Long-Term Advice

Credit card ka sahi use aapko financially strong bana sakta hai, lekin ghalat use aapko debt trap mein daal sakta hai.

Pakistan mein aksar log card ko loan samajh kar use karte hain, jabke credit card asal mein cashflow management ka tool hota hai. Agar aap har month full bill pay kar dete hain, to credit card ka koi bhi negative asar nahi hota.

Sab se important rule yeh hai ke jitna paisa cash mein afford nahi kar sakte, utna credit card se bhi spend mat karein. Installments sirf real emergencies mein hi use karein.

Har month statement check karein taake koi unknown transaction detect ho sake. Iss tarah na sirf aap apni financial life ko stable rakhte hain, balkay bank ke nazdeek reliable customer bhi ban jate hain.

Best Bank for Beginners – Mini Comparison Table

Yeh mini-table un readers ke liye hai jo first time credit card lena chahte hain aur confusion mein hotay hain.

| Beginner Need | Recommended Bank | Why It’s Beginner-Friendly |

| First credit card, low risk | Allied Bank | Simple cards, kam fee, straightforward process |

| Fast online application | Bank Alfalah | App-based apply, kam paperwork |

| Easy verification process | MCB | Clear eligibility, quick follow-ups |

| Rewards ke sath starter card | Standard Chartered | Cashback & discounts, strong support |

| Low income / no credit history | Alfalah / MCB (Secured) | Deposit-based card, approval easy |

Agar aap pehli dafa credit card le rahe hain, to basic ya secured card se start karna hamesha smart decision hota hai.

FAQs – Credit Card Kaise Banta Hai Pakistan Mein

Kya Pakistan mein first time credit card mil sakta hai

Haan, secured credit card ya basic card se start kiya ja sakta hai.

Credit card ke bina loan mil sakta hai

Mushkil hota hai, credit card history loan approval mein madad karti hai.

Kya student credit card apply kar sakta hai

Normally nahi, lekin secured card possible hota hai.

Credit card approval mein kitna time lagta hai

7 se 21 working days average hota hai.

Credit card limit kaise increase hoti hai

Time par payment aur stable income se.

Kya credit card online shopping ke liye safe hai

Haan, agar OTP aur secure sites use ki jayein.

Kya aik se zyada credit cards rakh sakte hain

Haan, lekin management strong honi chahiye.

Credit card band kaise karte hain

Bank ko written request aur dues clear kar ke.

Late payment se kya nuksan hota hai

Heavy interest aur credit score damage hota hai.

Secured credit card kab normal ban sakta hai

6–12 months good usage ke baad.

Kya annual fee waive hoti hai

Kabhi kabhi negotiation par possible hota hai.

Credit card se bill payments ka faida

Cash flow manage hota hai aur rewards milte hain.

Credit card fraud se kaise bacha jaye

OTP share na karein aur unknown links avoid karein.

Kya salary kam ho to card possible hai

Haan, lekin limit kam milegi ya secured option.

Credit card Pakistan mein worth it hai

Agar discipline ke sath use ho, to bilkul worth it hai.

Pakistan mein credit card kaise banta hai agar income kam ho?

Pakistan mein low income walay log secured credit card, supplementary card ya bank relationship ke zariye credit card le sakte hain.

Pakistan mein credit card apply karne par rejection kyun hoti hai?

Incomplete documents, low credit history, unstable income aur bank criteria follow na karna common rejection reasons hain.

Credit Card Kaise Banta Hai Pakistan Mein step-by-step?

Credit card Pakistan mein tab banta hai jab applicant bank ki income, documents aur credit history requirements complete karta ho.

See also:

Best Savings Account Pakistan in 2026 – Profit, Risks and Reality

Freelancer Tax Guide Pakistan – Woh Sach Jo Google Aur Fiverr Nahi Batate

Inflation Survival Tips for Pakistani Families (2026 Reality Check)

Online Fraud Prevention Pakistan – New Scams Targeting Families and Freelancers

Best Credit Card for Online Shopping Pakistan and Which One Is Safe for Online Shopping?

Credit Card Fraud Protection Pakistan – How People Lose Money Without Knowing

Best Investment Plan in Pakistan (2026) – Safe Aur Risky Options Ka Clear Comparison

Quick Summary (For Busy Readers):

- Pakistan mein credit card lena possible hai agar eligibility match kare

- First-time users ke liye basic ya secured card best hota hai

- Income consistency approval ka sab se strong factor hai

- Wrong card ke liye apply karna rejection ka main reason hota hai

Conclusion – Credit Card Kaise Banta Hai Pakistan Mein

Yeh baat confirm hai ke Pakistan mein credit card lena mushkil nahi hai, lekin bina planning ke apply karna risky ho sakta hai.

Jitni clarity aapko credit card ke process, fees aur usage ke baare mein hogi, utni hi easily aap approval hasil kar sakte hain.

Bas eligibility, documentation aur usage discipline samajh lein, phir credit card har situation mein aapka financial support ban sakta hai.

Agar aap first time credit card apply kar rahe hain, to pehle apni income aur bank relationship evaluate karna sab se smart step hota hai.

Disclaimer: Yeh article sirf general information ke liye hai. Credit card eligibility, approval aur terms bank policies ke mutabiq change ho sakti hain. Final decision se pehle apne bank ya financial institution se confirm zaroor karein.