Pakistan mein personal loan ka lafz sunte hi aksar log do extremes par chale jate hain.

Kuch log samajhte hain ke personal loan sirf emergency ke liye hota hai, jab ke kuch log isay bilkul avoid karte hain kyun ke unhein lagta hai ke yeh bohot mehnga aur risky hota hai.

Reality yeh hai ke personal loan ek financial tool hai — sahi planning ke sath liya jaye to help karta hai, aur bina planning ke liya jaye to pressure ban jata hai.

Zyada tar log personal loan lene mein is liye fail ho jate hain kyun ke unhein eligibility, bank requirements aur repayment reality ka andaza nahi hota.

Is personal loan kaise lein Pakistan main guide ka maqsad yeh hai ke personal loan ko simple aur practical tareeqay se samjhaya jaye, taake reader decision emotional nahi balkay logical le.

Personal Loan Kya Hota Hai Aur Kab Useful Hota Hai

Personal Loan Ka Basic Matlab

Personal loan ek aisa loan hota hai jo kisi specific cheez ke liye bound nahi hota. Aap isay medical expenses, wedding, education, home repair ya kisi aur zaroorat ke liye use kar sakte hain. Bank aap se yeh nahi poochta ke paisa kahan kharch hoga, balkay sirf yeh dekhta hai ke aap wapas kar sakte hain ya nahi.

Personal Loan Kab Lena Chahiye

Personal loan tab useful hota hai jab:

- Emergency ho aur savings kaafi na hon

- Expense one-time ho

- Repayment capacity clear ho

Personal loan ko lifestyle upgrade ke liye lena aksar ghalat decision sabit hota hai.

Pakistan Mein Personal Loan Eligibility – Ground Reality

Salary Based Applicants

Salary walon ke liye personal loan comparatively easy hota hai. Bank sab se pehle monthly income, job duration aur employer ki stability dekhta hai. Aksar kam az kam 6–12 mahine ki job history required hoti hai.

Business / Self-Employed Applicants

Business walon ke liye personal loan thora mushkil hota hai kyun ke income fluctuate karti hai. Is liye bank tax returns aur bank statements zyada detail mein analyze karta hai.

Personal Loan Eligibility

| Criteria | Salary Person | Business Person |

| Minimum income | Fixed salary | Average stable income |

| Work duration | 6–12 months | 1–2 years |

| Bank statement | Required | Strongly required |

| Tax record | Preferred | Very important |

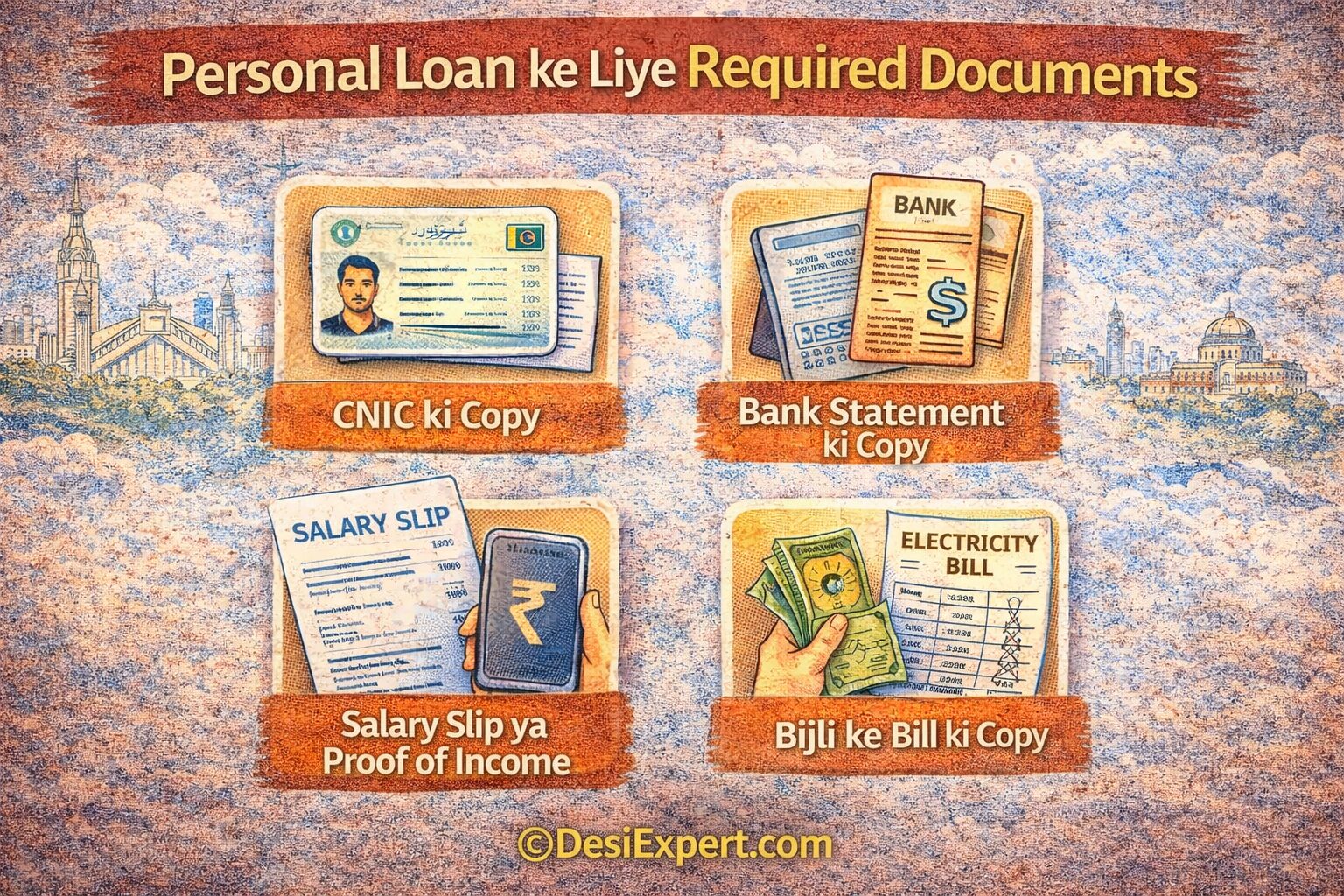

Personal Loan Ke Liye Required Documents

Salary Walon Ke Documents

CNIC copy, salary slips, bank statement, aur employment verification commonly required hotay hain. Yeh documents bank ko repayment ability ka proof dete hain.

Business Walon Ke Documents

Business proof, tax returns, bank statements aur CNIC required hota hai. In documents mein consistency sab se zyada important hoti hai.

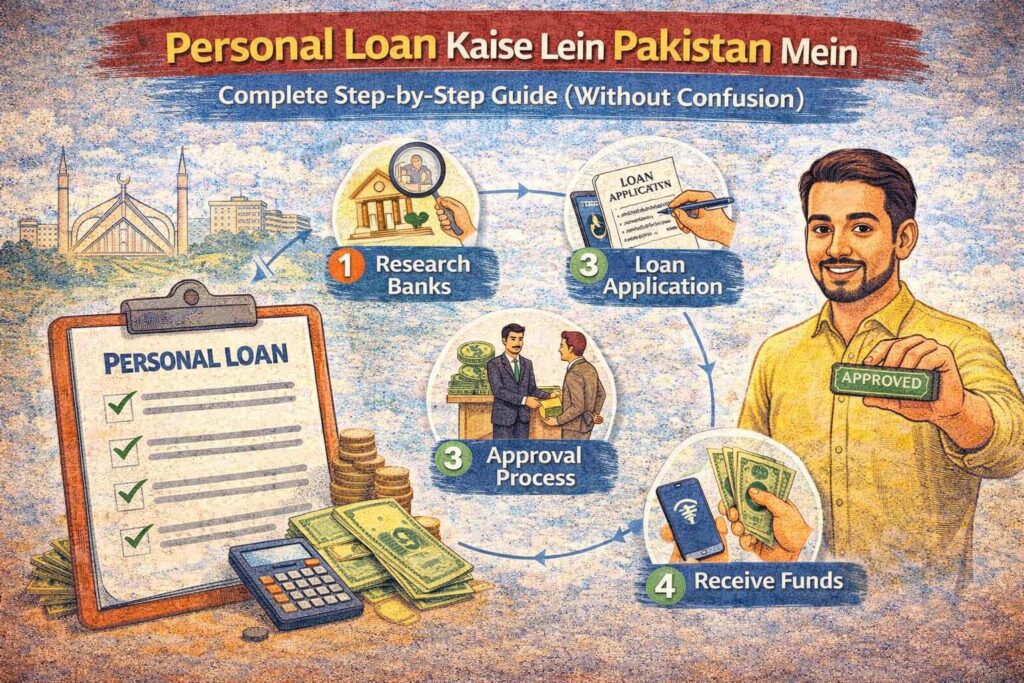

Personal Loan Apply Karne Ka Step-by-Step Tareeqa

Step 1: Apni Repayment Capacity Check Karein

Apply karne se pehle calculate karein ke monthly installment aap ki salary ya income ka kitna hissa hogi. Agar installment income ka bohot bara hissa ban rahi ho, to loan stress ban sakta hai.

Step 2: Loan Amount Realistically Decide Karein

Aksar log maximum loan apply kar dete hain jab ke unhein utna paisa zaroorat hi nahi hota. Sirf required amount lena long-term mein behtar hota hai.

Step 3: Loan Tenure Select Karein

Short tenure ka matlab kam markup, lekin zyada monthly installment. Long tenure ka matlab installment kam, lekin total markup zyada. Balance choose karna zaroori hota hai.

Step 4: Application Form Fill Karein

Form mein di gayi information bilkul accurate honi chahiye. Income ya job details ghalat dena rejection ka common reason hota hai.

Step 5: Bank Verification Aur Approval

Bank verification call ya visit karta hai jahan job, income aur address confirm hota hai. Approval ke baad loan amount release hota hai.

Personal Loan Mistakes

| Personal Loan Mistake | Log Kya Samajhte Hain | Asal Nuksaan |

| Maximum loan lena | “Baad mein manage ho jaye ga” | EMI burden barhta hai |

| EMI calculate na karna | “Salary se nikal jayegi” | Monthly stress |

| Markup ignore karna | “Bas installment dekho” | Total cost bohot zyada |

| Multiple banks apply | “Jahan mile le loon” | Rejection + profile weak |

| Emergency ke bajaye lifestyle use | “Loan hai to use bhi karna chahiye” | Debt trap |

| Due date miss karna | “1–2 din se kya hota hai” | Extra charges + record damage |

| Credit card ke sath loan | “Dono manage ho jayenge” | Double liability |

| Early settlement terms na parhna | “Jaldi close kar denge” | Extra penalty |

Personal Loan Markup Aur Charges Samajhna Zaroori Kyun Hai

Markup Kya Hota Hai

Markup woh amount hota hai jo bank aap se loan ke badlay leta hai. Yeh interest jaisa hi hota hai, aur tenure ke sath increase hota hai.

Common Charges

Processing fee, late payment charges aur early settlement charges personal loan ka hissa hotay hain. In ko ignore karna ghalat hota hai.

Personal Loan Charges – Overview Table

| Charge Type | Explanation |

| Markup | Loan ka interest |

| Processing fee | One-time fee |

| Late payment | Due date miss hone par |

| Early settlement | Loan jaldi close karne par |

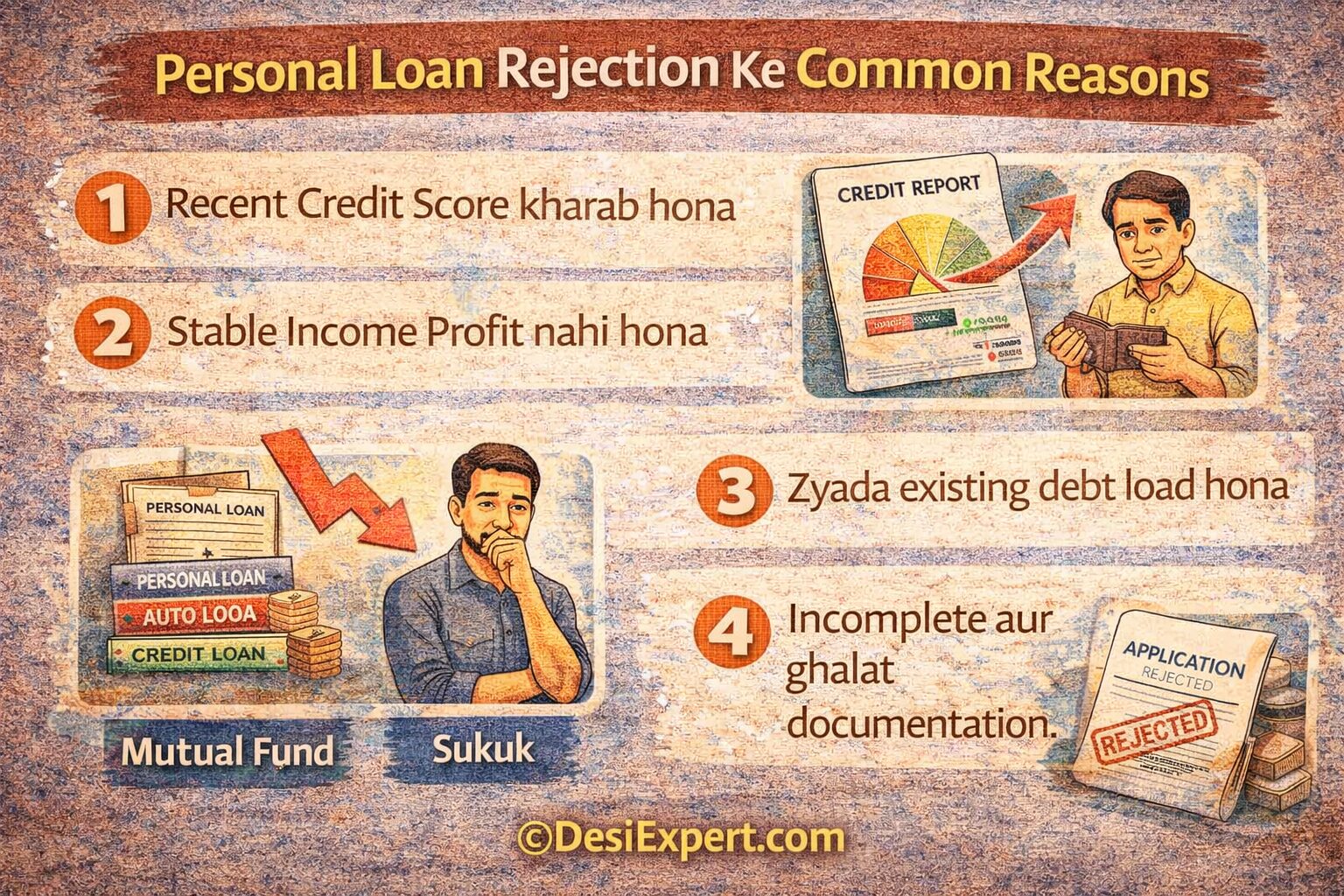

Personal Loan Rejection Ke Common Reasons

Income Criteria Meet Na Karna

Aksar applicants income requirement meet nahi karte, phir bhi apply kar dete hain.

Weak Bank History

Irregular transactions ya negative record bank ke liye red flag hota hai.

Over-Borrowing

Agar pehle se loans ya credit cards bohot zyada hon, to new loan reject ho jata hai.

Personal Loan Lena Hai Ya Alternative Use Karna Chahiye

Har situation mein personal loan best option nahi hota. Kabhi kabhi savings, installment plans ya partial payment zyada safe hoti hai. Loan tabhi lena chahiye jab clear repayment plan ho.

Personal Loan Ke Sath Smart Strategy

Personal loan ko temporary solution samjhein, permanent habit nahi. Jo log loan close hone ke baad bhi debt mein rehte hain, woh aksar financial pressure face karte hain.

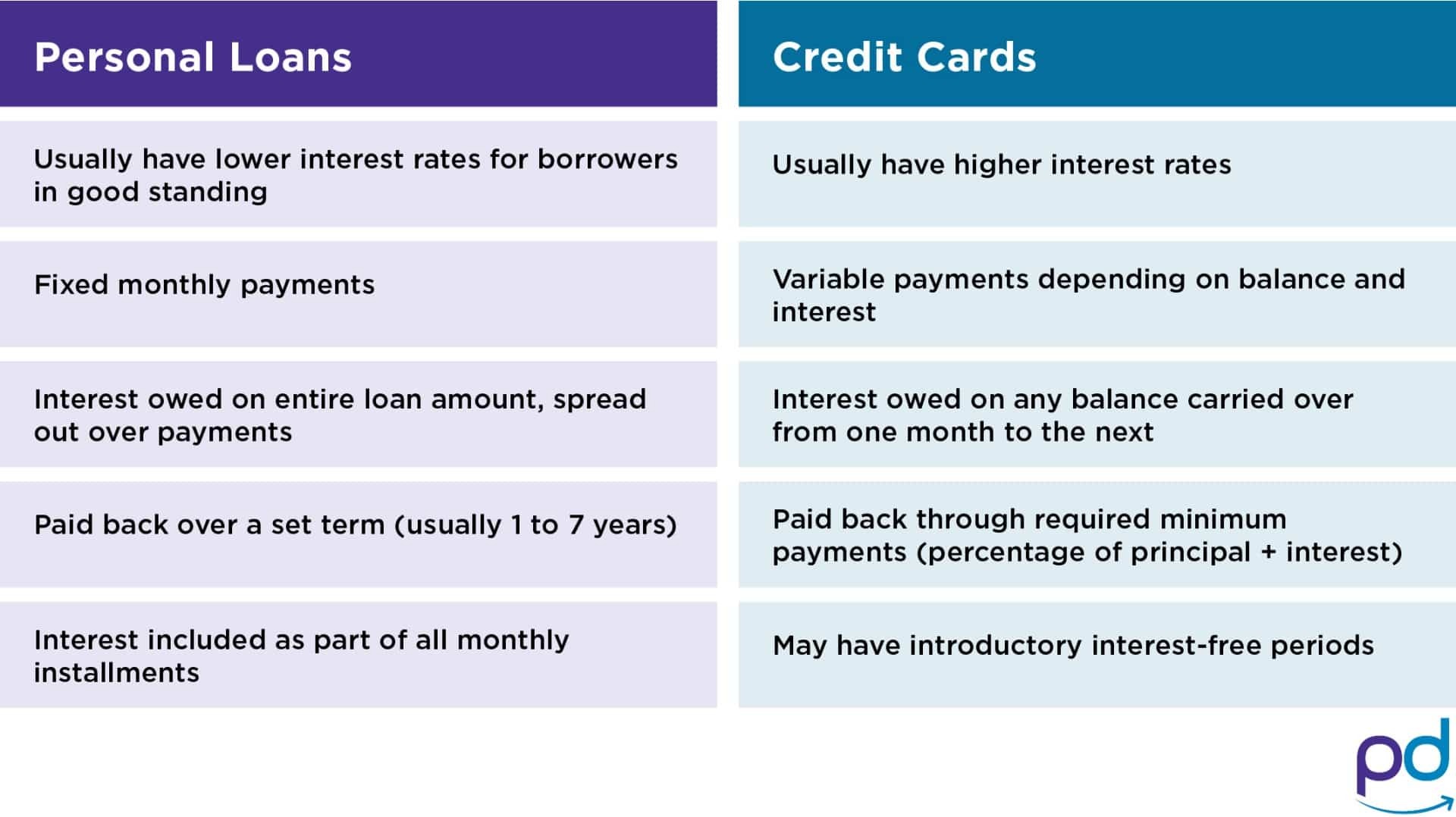

Personal Loan Aur Credit Card – Confusion Kyun Hoti Hai

Pakistan mein jab paison ki zaroorat hoti hai, to aksar log do options ke beech phans jate hain: personal loan ya credit card.

Dono ka kaam paisa provide karna hota hai, lekin dono ka structure, cost aur impact bilkul different hota hai.

Masla yeh hai ke zyada tar log sirf “kitna paisa mil jayega” dekhte hain, “kitna mehnga paray ga” aur “kitni dair tak bandha rahoon ga” yeh nahi sochte.

Is section ka maqsad yeh hai ke personal loan aur credit card ka farq sirf definitions mein nahi, balkay real-life usage ke context mein samjhaya jaye.

Personal Loan Kab Behtar Option Hota Hai

Personal loan tab zyada suitable hota hai jab:

- Expense one-time aur fixed ho (jaise medical, education, repair)

- Aap ko lump sum amount chahiye ho

- Repayment plan pehle se clear ho

- Aap long-term revolving debt nahi chahte

Personal loan mein installment fix hoti hai aur ek specific time ke baad loan khatam ho jata hai. Yeh cheez mentally aur financially zyada predictable hoti hai.

Credit Card Kab Behtar Option Hota Hai

Credit card tab useful hota hai jab:

- Expenses chhote chhote aur frequent hon

- Aap monthly full payment discipline follow kar sakte hon

- Short-term flexibility chahiye ho

- Emergency backup ki zaroorat ho

Credit card ka faida yeh hota hai ke agar full payment time par ho jaye to markup avoid ho sakta hai. Lekin agar discipline na ho, to yahi cheez mehngi bhi sabit hoti hai.

Personal Loan vs Credit Card Table

| Feature | Personal Loan | Credit Card |

| Paisa Milne Ka Tareeqa | Ek baar mein lump sum | Limit ke andar bar bar |

| Repayment | Fixed monthly installment | Flexible (minimum ya full) |

| Markup / Charges | Generally lower (long-term) | Higher agar balance carry ho |

| Tenure | Fixed (1–5 saal) | Open-ended |

| Discipline Required | Medium | High |

| Over-spending Risk | Kam | Zyada |

| Emergency Use | Limited | High |

| Credit Score Impact | Positive agar time par pay ho | Positive ya negative (usage par depend) |

| Best For | Planned expenses | Short-term needs |

| Beginner Friendly | Haan (agar plan ho) | Risky agar control na ho |

Beginners Ke Liye Kaunsa Option Zyada Safe Hai

Beginners ke liye general rule yeh hota hai:

- Large, planned expense → Personal Loan

- Small, manageable expense → Credit Card (full payment ke sath)

Agar beginner ko discipline par confidence nahi, to credit card se door rehna behtar hota hai. Personal loan kam flexibility deta hai, lekin isi wajah se control zyada hota hai.

Dono Options Ke Sath Common Mistake

Aksar log personal loan le kar phir bhi credit card use karte rehte hain. Is se double debt ka risk barh jata hai. Behtar approach yeh hoti hai ke ek waqt par ek hi major liability ho.

Ek aur common ghalti yeh hoti hai ke log credit card ko emergency ke bajaye lifestyle upgrade ke liye use karte hain. Phir jab bill aata hai, to stress shuru ho jata hai.

Decision Lene Ka Simple Formula

Agar aap yeh 3 sawal khud se pooch lein, to decision easy ho jata hai:

- Kya expense fixed hai ya repeat hota rahe ga?

- Kya main har month full payment discipline follow kar sakta hoon?

- Kya main har month full payment discipline follow kar sakta hoon?

Agar jawab clarity de de, to option bhi clear ho jata hai.

Personal Loan Lete Waqt Yeh Ghaltiyan Aap Ko Mehngi Par Sakti Hain

Section 1: Loan Lene Se Pehle Ki Ghaltiyan

- Sirf maximum amount dekh kar apply karna

- Repayment capacity calculate na karna

- Markup aur hidden charges ignore karna

- Multiple banks mein ek sath apply kar dena

Section 2: Loan Lene Ke Baad Ki Ghaltiyan

- EMI ke liye separate budget na banana

- Due date ko lightly lena

- Loan ke sath credit card overuse karna

- Extra paisa milte hi unnecessary kharch

Section 3: One-Line Reality

Loan paisa solve karta hai, planning ke baghair liya gaya loan problem ban jata hai.

Personal Loan Approval Fast Karne Ke Practical Tips

Tip 1: Sirf Eligible Amount Hi Apply Karein

Bank aap ki income ka ratio dekhta hai. Agar aap realistic amount apply karte hain, to approval chances kaafi barh jate hain.

Tip 2: Bank Statement Clean Rakhein

Apply karne se pehle 3–6 mahine tak bank account mein regular salary/income flow aur unnecessary cash withdrawals se parhez karein.

Tip 3: Existing Loans Aur Cards Control Mein Rakhein

Agar pehle se heavy EMI ya high credit card usage hai, to naya loan mushkil ho jata hai. Apply se pehle utilization kam karein.

Tip 4: Job / Business Stability Show Karein

Recent job change ya unstable income approval slow kar deta hai. Agar possible ho to stability period complete hone ke baad apply karein.

Tip 5: Documents Bilkul Complete Aur Accurate Dein

Incomplete ya inconsistent documents approval delay ka sab se common reason hotay hain. Salary, address aur CNIC details match honi chahiye.

Tip 6: Ek Bank, Ek Application

Ek waqt par sirf ek strong application submit karein. Multiple attempts profile ko weak dikha dete hain.

Tip 7: Repayment Intention Clear Rakhein

Verification call ke waqt confidently explain karein ke loan ka purpose aur repayment plan kya hai. Clear answers bank ka trust build karte hain.

Personal Loan Laise Lein Pakistan Main Guide – Frequently Asked Questions (FAQs)

Pakistan mein personal loan kaun le sakta hai?

Jo legal age ka ho aur income criteria meet karta ho.

Personal loan approval kitni dair mein hota hai?

Aksar 3–10 working days.

Kya student personal loan le sakta hai?

Generally nahi, jab tak income proof na ho.

Personal loan aur credit card mein kya farq hai?

Personal loan lump sum hota hai, credit card revolving hota hai.

Markup rate fix hota hai?

Aksar variable hota hai.

Early loan close karna faidemand hai?

Haan, agar charges manageable hon.

Kya business walon ko personal loan milta hai?

Haan, lekin documentation strong honi chahiye.

Personal loan ka credit score par asar hota hai?

Haan, time par payment score improve karti hai.

Ek sath do personal loans liye ja sakte hain?

Rare cases mein, lekin recommended nahi.

Loan reject ho jaye to dobara kab apply karein?

Profile improve karne ke baad.

Kya guarantor zaroori hota hai?

Kuch cases mein.

Personal loan emergency ke liye safe hai?

Haan, agar repayment plan clear ho.

Online personal loan apply karna safe hai?

Haan, agar official bank website ho.

Late payment ka nuksaan kya hai?

Extra charges aur record damage.

Personal loan sab se bari ghalti kya hoti hai?

Income se zyada installment lena.

See also:

Pakistan Mein Credit Card Apply Karne Ka Tareeqa (Step by Step)

Freelancer Tax Guide Pakistan – Woh Sach Jo Google Aur Fiverr Nahi Batate

Medical Insurance Low Budget – Pakistan Family Survival Guide

Best Life Insurance in Pakistan (2026) – Kaunsa Plan Waakai Family Ko Protect Karta Hai?

Conclusion of Personal Loan Laise Lein Pakistan Main Guide

Pakistan mein personal loan lena mushkil nahi, lekin samajh ke lena bohot zaroori hai.

Personal loan ek madadgar tool ho sakta hai agar amount realistic ho, tenure sahi ho aur repayment discipline strong ho.

Lekin bina planning ke liya gaya loan aksar financial tension ka sabab ban jata hai.

Jo log loan lene se pehle apni income, expenses aur future planning clear kar lete hain, un ke liye personal loan problem nahi balkay solution ban jata hai.

Decision paisay ka nahi, soch ka hota hai — aur sahi soch hi safe financial future ki bunyaad banti hai.