Aksar log Pakistan mein insurance ka naam suntay hi confuse ho jaate hain. Koi kehta hai savings plan lo, koi kehta hai life insurance zaroori hai, aur koi bilkul hi avoid kar deta hai. Is confusion ka sab se bara reason yeh hai ke term life insurance ka concept clear nahi hota.

Yeh term life insurance meaning pakistan guide un logon ke liye hai jo:

- family ke sole earner hain

- bachon ka future secure karna chahte hain

- kam paisay mein zyada protection chahte hain

- savings aur insurance ke farq ko samajhna chahte hain

Is article ke baad aap khud decide kar sakenge ke term life insurance aap ke liye sahi hai ya nahi.

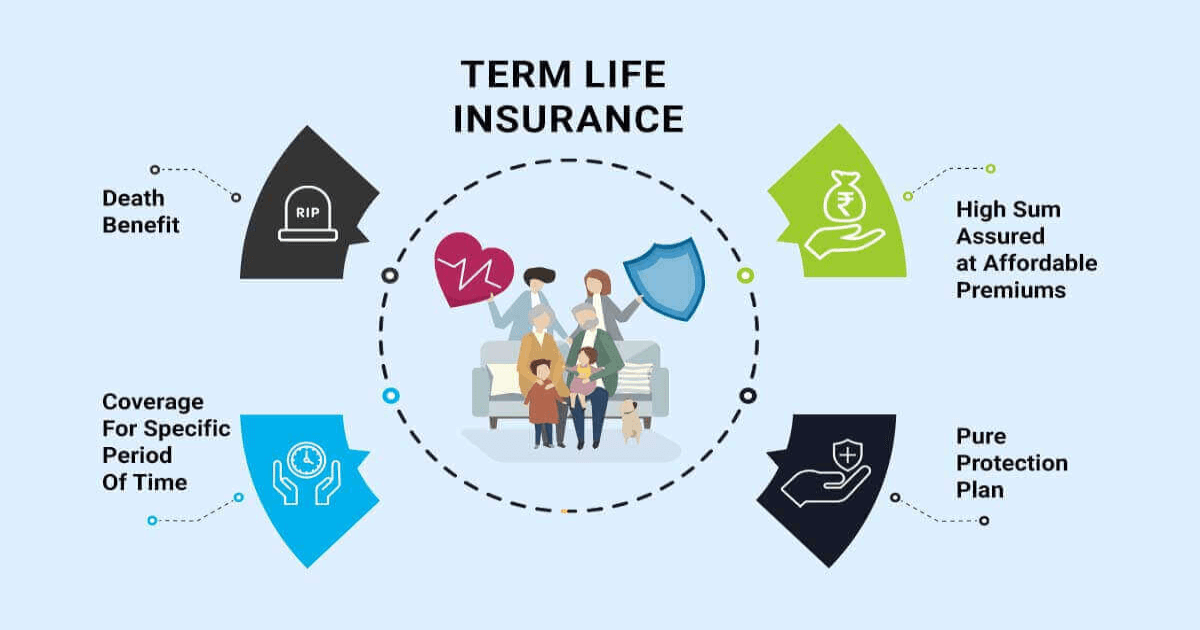

Term Life Insurance Kya Hoti Hai?

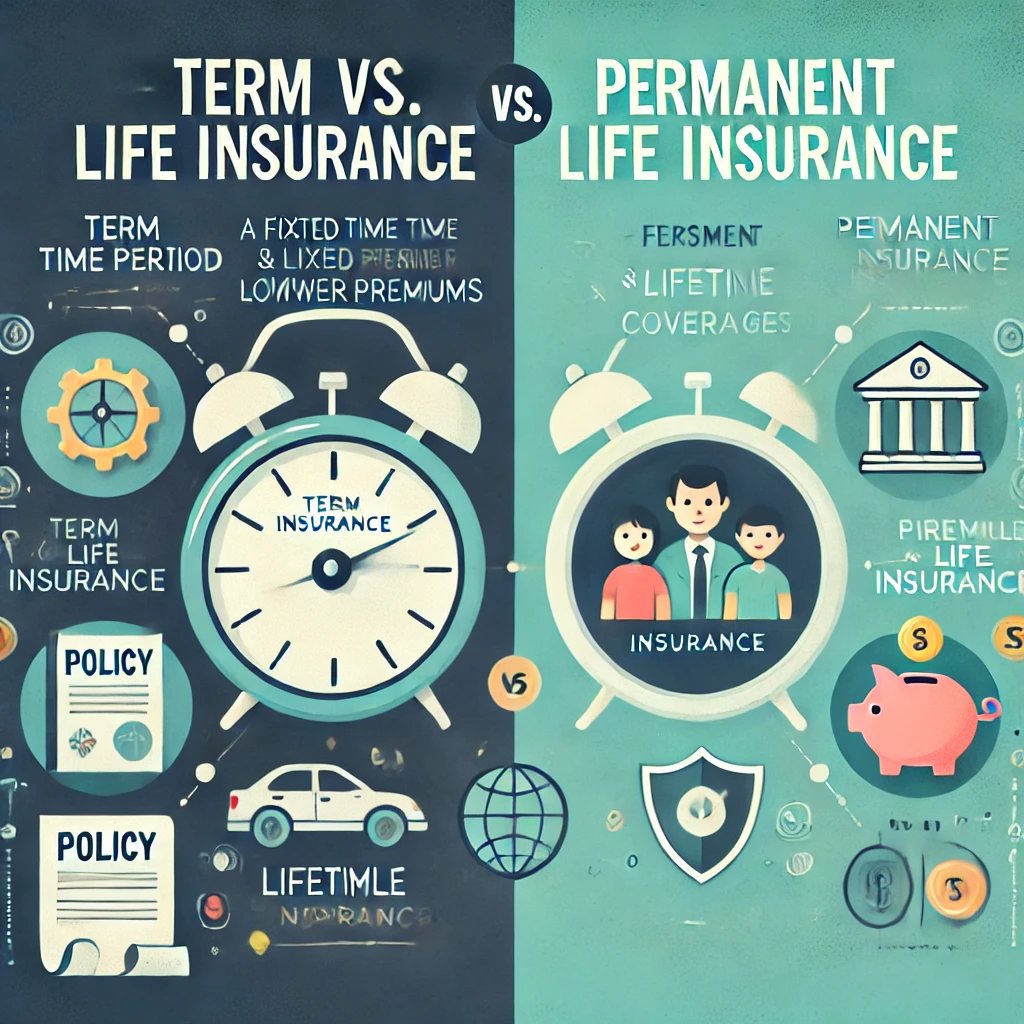

Term life insurance ek aisi life policy hoti hai jo sirf protection ke liye hoti hai — investment ya savings ke liye nahi.

Aap ek fixed time (term) ke liye policy lete hain, jaise:

- 10 saal

- 20 saal

- 30 saal

Agar is duration ke andar insured person ki death ho jaati hai, to family ko lump-sum amount milta hai. Agar term complete ho jaye aur insured zinda ho, to koi paisa wapas nahi milta.

Pakistan Mein Term Life Insurance Ka Basic Structure

Policy Kaise Kaam Karti Hai

- Aap yearly ya monthly premium dete hain

- Coverage sirf death ke case mein hoti hai

- Policy simple aur transparent hoti hai

- Premium dusri life policies se kaafi kam hota hai

Example

Agar koi 30 saal ka person:

- 20 saal ke liye

- 1 crore coverage ke saath

term policy leta hai

To monthly premium aam tor par bohot affordable hota hai — savings plans ke muqable mein.

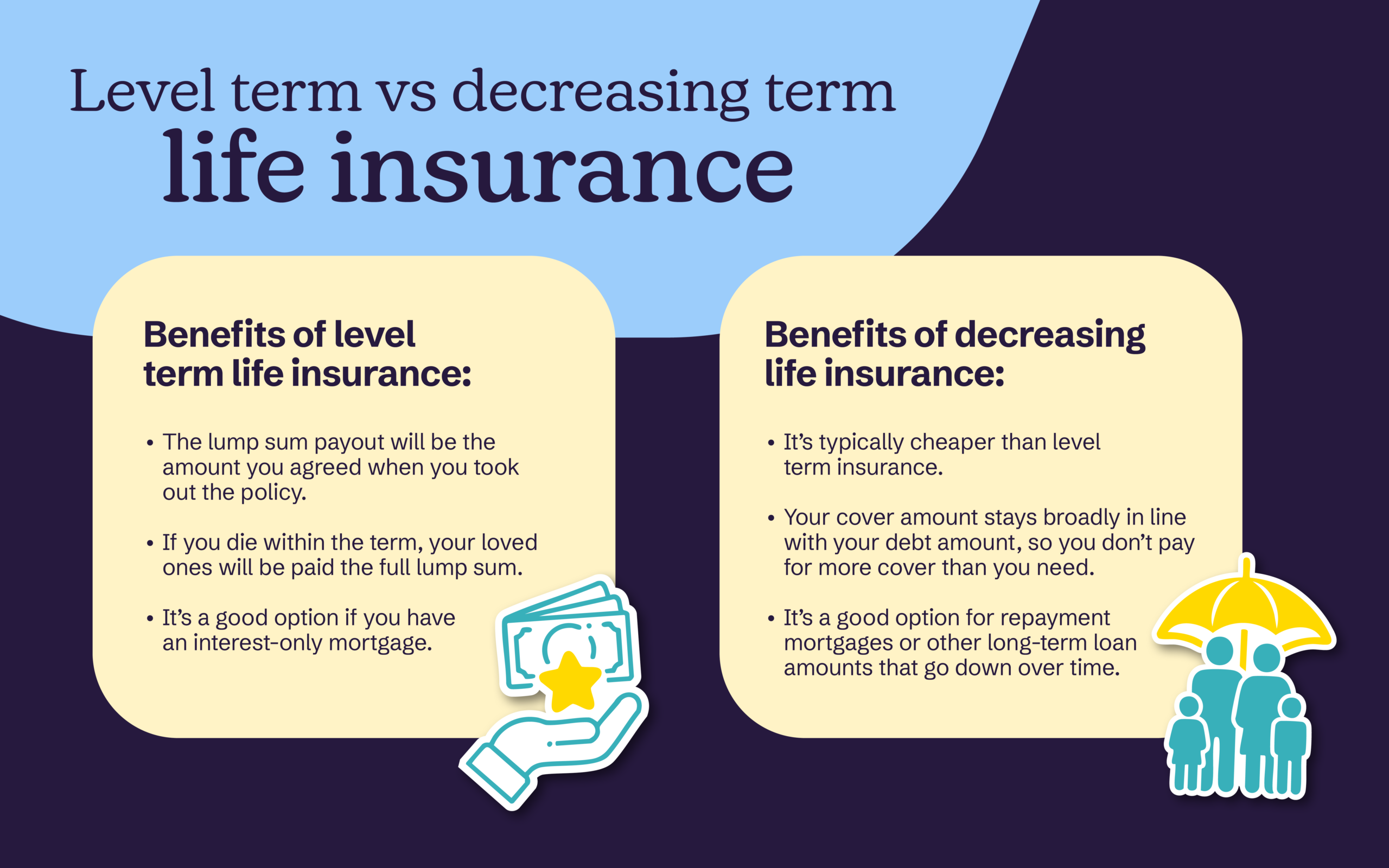

Term Life Insurance vs Savings Plans

| Feature | Term Life Insurance | Savings / Endowment Plans |

| Purpose | Sirf protection | Protection + investment |

| Premium | Kam | Zyada |

| Return | Sirf death par | Maturity + bonus |

| Transparency | High | Complex |

| Best For | Family protection | Long-term savings |

| Flexibility | Zyada | Limited |

👉 Important point:

Savings plans insurance ke naam par investment hote hain, jabke term insurance pure risk cover hoti hai.

Pakistan Mein Log Term Insurance Kyun Avoid Karte Hain?

Common Myths

“Agar kuch na hua to paisa zaya ho gaya”

Insurance ka purpose profit nahi, protection hota hai — bilkul seatbelt ki tarah.

“Savings plan zyada safe hota hai”

Savings plan mein aap zyada paisa dete hain, lekin coverage aksar kam hoti hai.

“Insurance companies claim nahi detin”

Agar policy terms follow ki jaayen aur documents clear hon, to claim rejection rare hota hai.

Term Life Insurance Kin Logon Ke Liye Best Hai?

Ideal Candidates

- Job holders

- Freelancers / online earners

- Business owners

- Married individuals

- Parents of young children

Agar aap ke income par family depend karti hai, to term life insurance almost zaroori ho jaati hai.

Pakistan Mein Term Life Insurance Ki Typical Coverage Amount

| Income Level | Recommended Coverage |

| 50k – 80k | 50–70 lakh |

| 1 lac – 2 lac | 1 crore |

| 3 lac + | 1.5–2 crore |

Rule of thumb:

👉 Annual income × 10–15 = ideal coverage

Term Life Insurance Mein Kya Cover Hota Hai?

Covered

- Natural death

- Accidental death

- Illness (policy terms ke mutabiq)

Not Covered (Usually)

- Suicide (initial years)

- Fraud / misinformation

- High-risk activities (agar disclose na ki hon)

Savings Plans Se Behtar Kyun Hai? (Practical Reasoning)

Savings plans mein:

- Aap zyada paisa lock kar dete hain

- Returns inflation ko beat nahi karte

- Insurance aur investment mix ho jaata hai

Term insurance + separate savings:

👉 zyada flexible

👉 zyada transparent

👉 better financial planning

Term Life Insurance Buying Mistakes (Avoid Karein)

Common Errors

- Sirf agent ki baat par bharosa

- Policy terms na parhna

- Under-insurance

- Medical history hide karna

Yeh galtiyan claim rejection ka sabab ban sakti hain.

Term Life Insurance Ka Claim Process (Simple Flow)

- Death certificate submit

- Policy documents verify

- Claim form fill

- Amount nominee ko transfer

Agar documentation clear ho, to process smooth hota hai.

Term Life Insurance Ka Duration Kaise Choose Karein?

Pakistan mein log aksar yahin par galti karte hain. Coverage to le lete hain, lekin term duration ghalat choose kar lete hain, jis se ya to:

- protection beech mein khatam ho jaati hai

- ya phir unnecessary lambi policy le lete hain

Rule jo yaad rakhein

Term life insurance ka duration aapke dependents ki zarurat ke end tak hona chahiye.

Example Scenarios

- Agar bachay 5 saal ke hain → policy kam az kam 20–25 saal

- Agar bachay university mein hain → 10–15 saal

- Agar spouse earning nahi karta → longer term zaroori

Goal yeh hota hai ke jab policy khatam ho, family financially independent ho chuki ho.

Term Life Insurance Aur Inflation Ka Real Connection

Aksar log kehte hain:

“20 saal baad 1 crore ki value kam ho jaayegi”

Yeh baat partially correct hai — lekin phir bhi term insurance powerful kyun rehti hai?

Iska Practical Answer

- Term insurance ka kaam profit generate karna nahi

- Iska kaam financial shock absorb karna hai

Agar aaj:

- ghar ka loan

- bachon ki education

- daily expenses

cover ho jaate hain, to inflation ka risk separate investments se manage hota hai, insurance se nahi.

👉 Insurance = Safety net

👉 Investment = Growth engine

Pakistan Mein Nominee Selection Ki Galtiyan

Policy lene ke baad log nominee ko serious nahi lete — jo baad mein legal headache ban sakta hai.

Common Mistakes

- Sirf spouse ka naam daal dena

- Minor bachay ko nominee bana dena (without guardian)

- Divorce / marriage ke baad update na karna

Best Practice

- Adult nominee + guardian details

- CNIC correctly entered

- Regular updates jab life change ho

Yeh choti cheezein claim settlement ko bohot smooth bana deti hain.

Term Life Insurance Freelancers & Online Earners Ke Liye

Pakistan mein freelancing aur online earning bohot common ho chuki hai, lekin is category ke log insurance se door rehte hain — jo ek serious risk hai.

Freelancers Kyun Zyada Risk Par Hote Hain?

- Fixed salary nahi hoti

- Employer benefits nahi hotay

- Medical / insurance cover nahi milta

Term Insurance Yahan Kaise Help Karti Hai?

- Low premium

- High coverage

- Income proof ke through approval

Agar koi freelancer monthly 150k–200k kama raha hai, to 1–1.5 crore coverage bilkul realistic hoti hai.

Term Life Insurance Aur Loans (Hidden Benefit)

Aksar log yeh nahi jaante ke term life insurance loan protection tool bhi hoti hai.

Covered Loans Examples

- Home loan

- Business loan

- Personal loan

Agar insured person ki death ho jaaye:

- family par loan ka pressure nahi aata

- assets (ghar, shop) save rehte hain

Isi liye banks bhi aksar term cover recommend karti hain.

Term Life Insurance Ke Add-ons (Riders) – Kab Zaroori, Kab Nahi

Riders extra features hotay hain jo basic policy ke sath attach hote hain.

Useful Riders

- Accidental death benefit

- Disability cover

- Critical illness rider

Kab Avoid Karein

- Jab premium unnecessarily barh jaaye

- Jab rider terms unclear hon

👉 Rule: Sirf woh rider lo jo real-life risk cover karta ho

Term Life Insurance Aur Tax Angle

Boht se log insurance ko tax saving ke liye lete hain — lekin term insurance ka primary benefit tax nahi, protection hai.

Realistic View

- Kuch tax relief ho sakta hai

- Lekin savings plans jaisa major tax shield nahi

Isliye sirf tax ke liye policy lena ghalat approach hoti hai.

Agar Term Life Insurance Na Ho To Kya Hota Hai? (Reality Check)

Yeh harsh lag sakta hai, lekin reality yeh hai:

Agar sole earner ki death ho jaaye aur:

- savings limited hon

- loans outstanding hon

- income replace na ho

To family ko:

- ghar sell karna padta hai

- bachon ki education affect hoti hai

- lifestyle drastically gir jaata hai

Term life insurance yeh chain reaction tod deti hai.

Term Life Insurance Kab Avoid Karni Chahiye?

Haan — kuch cases mein term insurance zaroori nahi hoti.

Avoid If

- Koi dependent nahi

- Already financially independent family

- Elderly age with no liabilities

Insurance ka rule simple hai:

Jab risk ho, tab insurance

Term Life Insurance Planning Checklist (Before You Buy)

Use is list ko final decision se pehle:

- ✔ Dependents identified

- ✔ Coverage calculation done

- ✔ Term duration clear

- ✔ Medical history disclosed

- ✔ Nominee updated

- ✔ Policy terms read

Agar yeh 6 cheezein clear hain, to aap 90% mistakes se bach jaate hain.

Term Life Insurance Long-Term Peace Kyun Deti Hai?

Iska jawab paisay mein nahi — mental peace mein chhupa hai.

- Family secure hoti hai

- Decisions pressure-free hotay hain

- Financial planning clear hoti hai

Isi liye financial planners kehte hain:

“Term insurance is boring — but essential.”

Term Life Insurance Decide Karne Ka Simple Formula (Real-Life Use)

Agar abhi bhi confusion ho ke kitni coverage aur kaunsi policy sahi rahegi, to is simple formula ko follow karein. Ismein koi financial jargon nahi — sirf practical soch.

Step 1: Annual Expense Multiply Method

Apni family ka 1 saal ka total kharcha calculate karein:

- ghar ka kharcha

- school / university fees

- utilities

- medical buffer

Ab is amount ko 15 se 20 saal se multiply karein.

Yeh aapki base coverage ban jaati hai.

Step 2: Outstanding Liabilities Add Karein

Is base coverage mein add karein:

- home loan

- personal / business loan

- credit card dues

Is tarah aapki family par koi financial bojh nahi rehta.

Step 3: Existing Savings Minus Karein

Agar:

- savings accounts

- investments

- provident fund

maujood hain, to unhein minus karein.

Jo final figure bache — wahi realistic term life cover hota hai.

Term Life Insurance Aur Emotional Decision Making

Aksar log insurance ko sirf numbers se judge karte hain, jabke asal decision emotional responsibility se linked hota hai.

Sochiye:

- agar aaj aap na hon

- to kya family ke paas time hoga adjust hone ka?

- ya turant paison ki tension shuru ho jaayegi?

Term life insurance ka sab se bada faida yahi hai ke:

family ko time milta hai — panic nahi hoti.

One-Line Truth Jo Yaad Rakhein

Term life insurance:

- ameer nahi banati

- lekin ghar ko financial collapse se bachati hai

Aur Pakistan mein —

jahan income ek banday par dependent hoti hai —

yeh protection delay karne wali cheez nahi.

TERM LIFE vs ENDOWMENT — FINAL VERDICT BOX

Yeh section readers ke liye “decision-maker” ka kaam karega

(Google ko bhi strong comparison signal milta hai)

🔷 Term Life Insurance — Kis Ke Liye Best Hai?

- Jo maximum protection kam premium mein chahte hain

- Jinke paas family dependents hain

- Jo insurance ko investment nahi, safety tool samajhte hain

- Freelancers, job holders, business owners ke liye ideal

Reality:

Agar insured person ki death ho jaaye → family ko full lump-sum milta hai

Agar term poori ho jaaye → koi payout nahi (aur yahi iska purpose hai)

🔶 Endowment / Savings Plans — Kis Ke Liye?

- Jo forced saving chahte hain

- Jinke paas already basic protection maujood ho

- Jo low-risk, low-return approach pasand karte hain

Reality:

- Premium zyada

- Coverage kam

- Returns aksar inflation se bhi neeche

FAQs – Term Life Insurance Pakistan

1. Kya term life insurance halal hai?

Policy ki structure aur clauses par depend karta hai. Is liye har plan ke terms carefully check karna zaroori hota hai.

2. Term life insurance aur takaful mein kya farq hai?

Term life conventional model hota hai, jabke takaful cooperative model par based hota hai. Coverage concept dono mein similar hota hai.

3. Pakistan mein term life insurance kis age tak mil sakti hai?

Usually 18 se 65 saal tak. Kuch providers 70 tak allow karte hain.

4. Agar medical issue ho to kya policy mil sakti hai?

Mild conditions mein mil jaati hai, lekin premium thora zyada ho sakta hai. Severe cases mein rejection bhi ho sakti hai.

5. Term life insurance ka claim kaise hota hai?

Nominee documents submit karta hai → verification hoti hai → payout release hota hai. Correct nominee details bohot important hoti hain.

6. Kya term life insurance loan ke liye useful hai?

Haan. Agar insured person ki death ho jaaye, to outstanding loan cover ho jata hai.

7. Agar policy lapse ho jaaye to kya hota hai?

Coverage khatam ho jaati hai. Is liye premium discipline bohot zaroori hai.

8. Kya term insurance freelancer le sakta hai?

Bilkul. Income proof ke sath freelancer bhi apply kar sakta hai.

9. Term life insurance aur job benefits mein kya farq hai?

Job-based insurance temporary hoti hai. Term life personal aur long-term hoti hai.

10. Kya ek se zyada term policies le sakte hain?

Haan. Lekin total coverage income ke proportional honi chahiye.

11. Kya term insurance retirement ke baad useful hoti hai?

Agar dependents hain ya liabilities baqi hain, to haan.

12. Term life insurance ka premium kyun low hota hai?

Kyunke ismein savings ya maturity payout nahi hota — sirf protection hoti hai.

13. Kya policy mid-term cancel ki ja sakti hai?

Haan, lekin koi refund nahi hota.

14. Kya policy ke baad nominee change ho sakta hai?

Haan, life changes ke baad nominee update karna bohot zaroori hota hai.

15. Term life insurance kab lena best hota hai?

Jitni jaldi lein, utna premium kam hota hai — aur coverage lambi milti hai.

Q16: Kya term life insurance halal hai?

Is ka jawab company aur structure par depend karta hai. Conventional aur Takaful options alag hotay hain.

Q17: Kya term insurance maturity par paisa deti hai?

Nahi, sirf death case mein.

Q17: Kya freelancers bhi le sakte hain?

Haan, income proof ke sath.

Q18: Kya term policy loan ke liye use hoti hai?

Nahi, yeh sirf protection hoti hai.

Q19: Kya multiple term policies le sakte hain?

Haan, agar income support karti ho.

Q20: Policy kab start hoti hai?

Premium payment ke baad.

Q21: Age limit kya hoti hai?

Usually 18–65 years.

Q22: Medical test zaroori hota hai?

High coverage par aksar hota hai.

Q23: Kya premium change hota rehta hai?

Nahi, fixed hota hai.

Q24: Kya policy mid-term cancel ho sakti hai?

Haan, lekin refund nahi hota.

Q25: Kya nominee change ho sakta hai?

Haan, anytime.

Q26: Best term duration kya hai?

Jab tak dependents financially independent ho jaayen.

Q27: Kya overseas Pakistanis le sakte hain?

Kuch companies allow karti hain.

Q28: Claim settle hone mein kitna time lagta hai?

Documents clear hon to 30–60 days.

Q29: Term insurance savings se zyada safe hai?

Protection ke liye — yes.

See also:

Best Life Insurance in Pakistan (2026) – Kaunsa Plan Waakai Family Ko Protect Karta Hai?

UAE Medical Insurance Best Plans | Health Insurance UAE Comparison 2026

Best Savings Account Pakistan in 2026 – Profit, Risks and Reality

Conclusion – Term Life Insurance Meaning Pakistan

Agar aap ka goal family protection hai aur aap zyada paisa lock nahi karna chahte, to term life insurance Pakistan mein sab se practical option hai. Savings plans apni jagah, lekin insurance ko investment samajhna aksar mehnga decision sabit hota hai.

FINAL VERDICT (No Confusion Rule)

| Situation | Best Choice |

| Family dependents hain | Term Life |

| Budget limited hai | Term Life |

| Protection priority hai | Term Life |

| Sirf savings chahiye | Endowment |

| Dono chahiye | Term + Separate Investment |

Pakistan jaise mulk mein:

Term life + simple investments = sab se smart combo

Pakistan jaise mulk mein jahan:

- inflation high hai

- savings limited hoti hain

- social safety net weak hai

wahan term life insurance luxury nahi, necessity hai.

Yeh policy ameer banane ka tool nahi —

lekin gharelu financial disaster se bachane ka strongest shield zaroor hai.

Agar aap:

- kam premium

- high protection

- simple structure

chahte hain, to term life insurance savings plans se zyada logical choice hai.

Smart strategy yeh hai:

- Term insurance se protection

- Separate saving/investment se wealth

Is tarah aap financially balanced aur secure rehte hain.